View from the Observation Deck

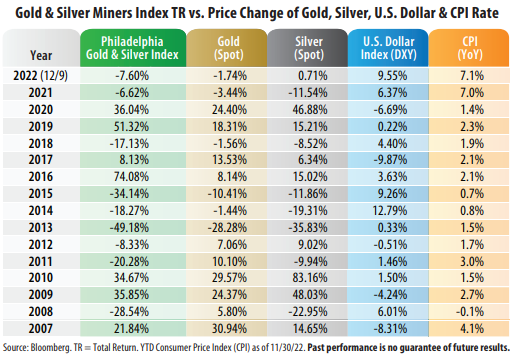

1. Today's blog post illustrates the wide disparities that often exist between the annual price performance of an ounce of gold bullion, silver and the equity returns posted by the mining companies.

2. Since precious metals tend to be priced in U.S. dollars, investors should also be aware of the relative strength of the U.S. dollar against other major global currencies, in our opinion.

3. Precious metals have historically been considered potential inflation hedges by investors. From 1926-2021, the CPI rate averaged 3.0%, according to data from the Bureau of Labor Statistics. It stood at 7.1% on a trailing 12-month basis in November 2022.

4. As of 12/9/22, the price of gold closed trading at $1,797.32 per ounce, according to Bloomberg. The all-time closing high for the spot price is $2,060.59 per ounce, set on 8/6/20.

5. From 2007 through 2021, the Philadelphia Stock Exchange Gold & Silver Index only posted a positive total return in seven of the 15 calendar years, but four of them occurred from 2016 through 2020. It is in negative territory YTD.

6. As of 12/13/22, Bloomberg's earnings per share figures (in dollars) for 2019, 2020, and 2021 (actual earnings) and consensus estimated earnings per share for 2022, 2023, and 2024 for the Philadelphia Stock Exchange Gold & Silver Index were as follows: $1.00 (2019); $4.62 (2020); $5.63 (2021); $4.22 (2022 Est.); $5.35 (2023 Est.); and $5.80 (2024 Est.).

7. We last discussed this topic on 8/9/22 (click here). Since then, gold, silver, and mining stocks have benefitted from a simultaneous decline in Treasury yields and the U.S. dollar, in our opinion.

8. Quarter-to-date through 12/9/22, the prices of gold and silver rose 8.23% and 23.36%, respectively, while the total return on the Philadelphia Stock Exchange Gold & Silver Index was 19.37%.