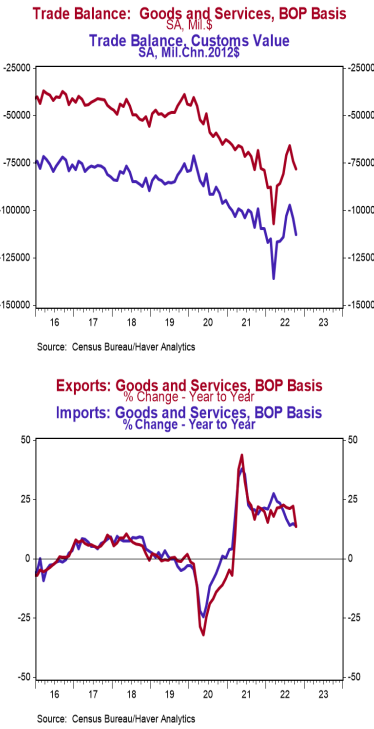

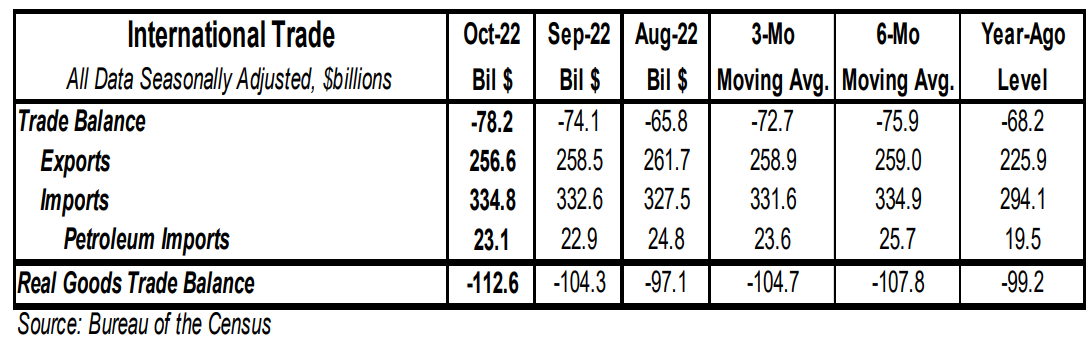

- The trade deficit in goods and services came in at $78.2 billion in October, smaller than the consensus expected $80.0 billion.

- Exports declined by $1.9 billion, led by declines in pharmaceuticals, natural gas, and other petroleum products. Imports rose by $2.2 billion, led by pharmaceuticals, other goods, and autos.

- In the last year, exports are up 13.6% while imports are up 13.9%.

- Compared to a year ago, the monthly trade deficit is $10.0 billion larger; after adjusting for inflation, the “real” trade deficit in goods is $13.4 billion larger than a year ago. The “real” change is the trade indicator most important for measuring real GDP.

Implications:

The trade deficit in goods and services came in at $78.2 billion in October as imports grew while exports declined. Demand for US goods and services across the globe continues to struggle as a stronger dollar is making US goods much more expensive internationally. We like to follow the total volume of trade (imports plus exports), which signals how much businesses and consumers interact across the US border. That measure rose by $0.3 billion in October, and is up a robust 13.7% versus a year ago. Unfortunately, the large increase in the past year is driven not only by more goods and services, but also higher prices. Note that Russia’s invasion of Ukraine and COVID restrictions in China, although the latter are potentially easing, may affect trade patterns for some time. The good news is that supply-chain problems look to be improving across the board. For example, a few weeks ago, Captain Kip, the Executive Director of Marine Exchange of Southern California declared the container ship backup has finally ended. After twenty-five months, things are finally back to normal at the Ports of LA and Long Beach. In some cases waits have just shifted to other ports, but daily freight rates are also falling rapidly as demand has also weakened. A large part of this is due to a collapse in manufacturing orders in China, which has led to a 21% decline in total vessel container volume between August and November according to supply chain research firm Project44. Also notable in today’s report, the dollar value of US petroleum exports exceeded imports. So far this year US petroleum exports have exceeded imports in seven of nine months. Exports of US crude oil and refined products continue to hover near record highs, meaning that much of the release from the Strategic Petroleum Reserve is just flowing overseas.