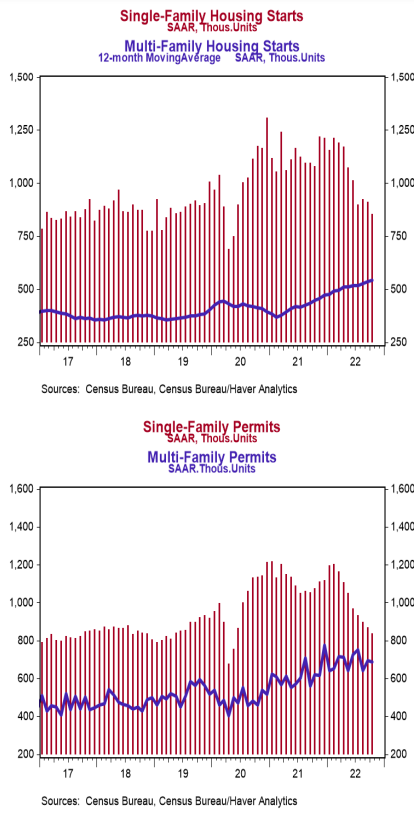

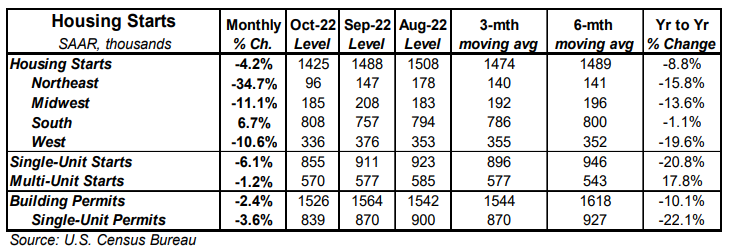

- Housing starts fell 4.2% in October to a 1.425 million annual rate, beating the consensus expected 1.410 million. Starts are down 8.8% versus a year ago.

- The drop in October was due to both single-family and multi-unit starts. In the past year, single-family starts are down 20.8% while multi-unit starts are up 17.8%.

- Starts in October fell in the Northeast, Midwest, and West, but rose in the South.

- New building permits declined 2.4% in October to a 1.526 million annual rate, beating the consensus expected 1.514 million. Compared to a year ago, permits for single-family homes are down 22.1% while permits for multi-unit homes are up 10.6%.

Implications:

Housing starts continued to slow in October as relatively high mortgage rates, labor shortages, and ongoing supply-chain issues continue to weigh on builders. Looking at the details, both single-family and multi-unit construction contributed to the headline decline. It is clear developers are becoming more cautious about future demand for new single-family projects with 30-year mortgage rates near 7.0% and are continuing to focus resources on apartment buildings, instead. Over the past year single-family starts are down 20.8%, a sharp contrast to multi-unit starts which are up 17.8%. Though groundbreaking on new residential projects is now down 21.1% from the peak earlier this year, keep in mind that construction overall has hardly ground to a halt. Lots of projects are already in the pipeline, with the number of homes under construction at the highest level on record back to 1970. These figures demonstrate a slower construction process due to a lack of workers and other supply-chain difficulties. Given that builders already have their hands full, it wasn’t surprising to see permits for new projects fall 2.4% in October. The backlog of projects that have been authorized but not yet started is currently just below the record high since the series began back in 1999. Housing isn’t going to be a source of economic growth in the year ahead, but do not expect a housing bust nearly as harsh as in the 2000s. Unlike the previous housing bust, we do not have a massive oversupply of homes. In other news this morning, initial unemployment claims fell 4,000 last week to 222,000. Continuing claims rose 13,000 to 1.507 million. These figures are low by historical standards and suggest continued solid job growth in November. Finally, on the manufacturing front, the Philadelphia Fed Index, a measure of factory sentiment in that region, fell to -19.4 in November from -8.7 in October. We will be watching other regional surveys closely for any signs of a broader decline in that sector.