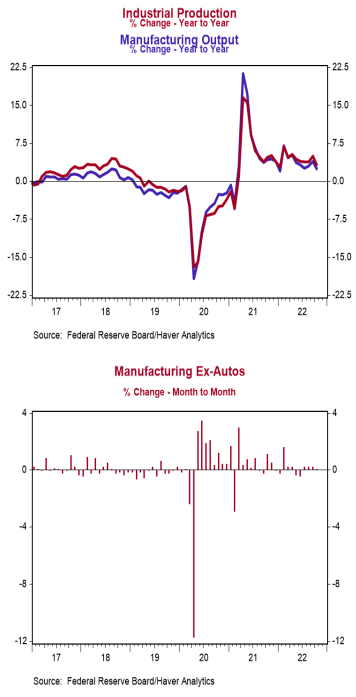

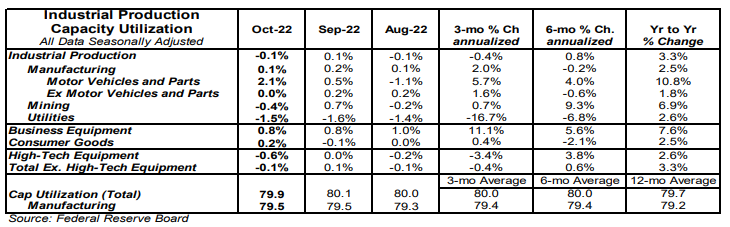

- Industrial production declined 0.1% in October (-0.5% including revisions to prior months), lagging the consensus expected gain of 0.2%. Utilities output fell 1.5% in October, while mining dropped 0.4%.

- Manufacturing, which excludes mining/utilities, increased 0.1% in October (-0.4% including revisions to prior months). Auto production rose 2.1%, while non-auto manufacturing remained unchanged. Auto production is up 10.8% in the past year, while non-auto manufacturing is up 1.8%.

- The production of high-tech equipment declined 0.6% in October, but is up 2.6% versus a year ago.

- Overall capacity utilization declined to 79.9% in October from 80.1% in September. Manufacturing capacity utilization remained unchanged at 79.5% in October.

Implications:

Industrial activity in the US took a breather in October, coming in weaker than expected. Moreover, data from prior months were revised down as well, largely the result of growth in the manufacturing sector being slower than previously reported. That said, manufacturing is hardly signaling recession. In fact, it was the only major category to eke out a gain in today’s report, posting a fourth consecutive monthly gain. The auto sector was the driver of activity in October, with activity rising 2.1%. Meanwhile, manufacturing outside the auto sector was unchanged for the month. Given the recent trend of Americans shifting their consumption preferences back toward services and away from goods, the downward revisions in today’s report aren’t surprising. That said, the production of consumer goods is up 2.5% in the past year while the production of business equipment is up 7.6%. This signals that investment in capital goods might be beginning to drive demand for the manufacturing sector as end-consumers ease up. Turning to the sources of weakness in today’s report, mining posted a decline of 0.4% in October as a slower pace of crude oil extraction more than offset gains in the extraction of natural gas and other minerals as well as the drilling of new wells. We don’t expect weakness to persist in the mining sector with oil prices currently still hovering above $80 a barrel, incentivizing new exploration. Finally, the utility sector (which is largely dependent on weather), posted a decline of 1.5% in October. Overall, despite the shift back toward services, we expect continued modest gains in industrial production through the end of 2022 as demand continues to outstrip supply. Today’s report puts industrial production 2.9% above pre-pandemic levels. In comparison, this morning’s report on retail sales shows that after adjusting for inflation, “real” retail sales are up 14.7% over the same period. This mismatch between supply and stimulus-boosted demand shows why inflation remains uncomfortably high. In other news this morning, homebuilder sentiment, as measured by the NAHB Housing Index, continues to deteriorate. The index fell for an eleventh consecutive month to 33 in November. An index reading below 50 signals that more builders view conditions as poor vs. good. The prime concern continues to be higher mortgage rates, which are having a negative impact on potential sales as certain buyers are at least temporarily priced out of the market, leaving some builders with a surplus of inventory.