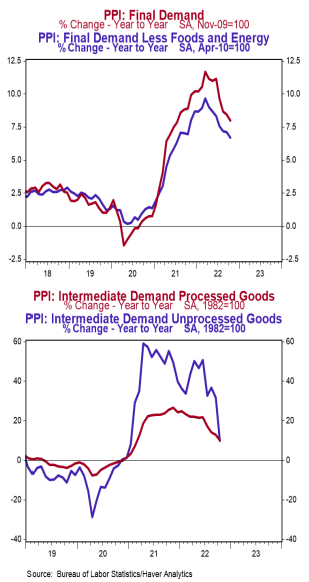

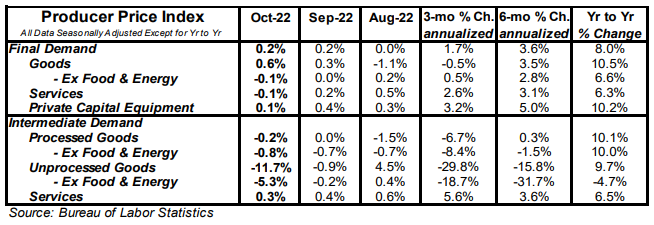

- The Producer Price Index (PPI) rose 0.2% in October, coming in below the consensus expected +0.4%. Producer prices are up 8.0% versus a year ago.

- Energy prices rose 2.7% in October, while food prices increased 0.5%. Producer prices excluding food and energy were unchanged in October, but remain up 6.7% in the past year.

- In the past year, prices for goods are up 10.5%, while prices for services have risen 6.3%. Private capital equipment prices increased 0.1% in October and are up 10.2% in the past year.

- Prices for intermediate processed goods declined 0.2% in October but are up 10.1% versus a year ago. Prices for intermediate unprocessed goods declined 11.7% in October but remain up 9.7% versus a year ago.

Implications:

Peak inflation is likely behind us, but today’s modest 0.2% rise in producer prices is not a sign that the Fed’s job is done. Yes, producer prices have been rising at a slower pace over the past three- and six-month periods, but prices remain up 8.0% in the past year, well ahead of the Fed’s 2% target for inflation. After declining in July and showing no change in August on the back of lower energy costs, producer prices have risen by 0.2% in both September and October, with food and energy again key drivers, rising 0.5% and 2.7%, respectively, in October. Outside these typically volatile categories, “core” producer prices were flat in October as a drop in autos, declining margins to wholesalers, and lower costs for wholesaling and transportation services were offset by rising costs for hospital care and oil & gas field machinery. While it’s notable that this is the first time in nearly two years that core prices did not increase on a monthly basis, they still remain up 6.7% in the past year. Producer prices may very well have peaked on a year-ago basis back in March, but it will not be a swift return to the Fed’s target of 2% annual inflation. We expect the path toward “normal” will be far stickier than most anticipate as the economy continues to absorb the massive surge in the M2 measure of money the Fed injected in 2020-21. While there is plenty of prognostication around what the Fed will do and what that means for the economy – and the markets – moving forward, what matters most is that inflation continues to run well above the Fed’s target. Expect a 50 basis point rate hike at the Fed’s December meeting, along with guidance that the Fed is prepared to continue raising rates in 2023. The path ahead to tame inflation will test the Fed’s resolve, let’s hope they are up to the task. In recent news on the manufacturing front, the Empire State Index, a measure of New York factory sentiment, rose to 4.5 in November from -6.0 in October. The US is likely headed for a recession, but it hasn’t started yet.