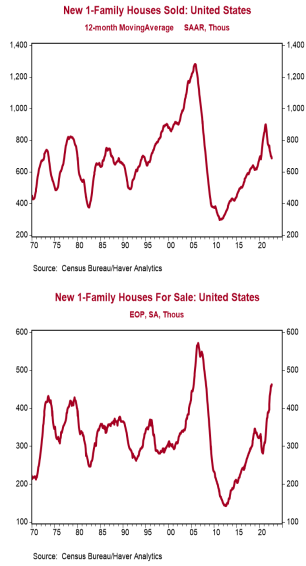

- New single-family home sales declined 10.9% in September to a 0.603 million annual rate, beating the consensus expected 0.580 million. Sales are down 17.6% from a year ago.

- Sales in September fell in the South and West, but rose in the Northeast and Midwest.

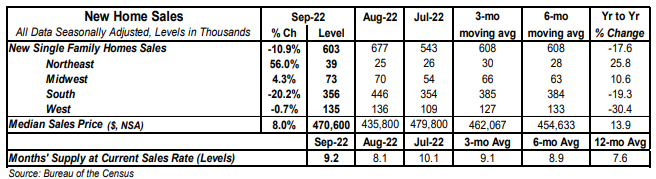

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) rose to 9.2 in September from 8.1 in August. The gain was due to both a slower pace of sales and a 5,000 unit increase in inventories.

- The median price of new homes sold was $470,600 in September, up 13.9% from a year ago. The average price of new homes sold was $517,700, up 10.0% versus last year.

Implications:

Although beating consensus expectations, sales of new homes fell 10.9% in September and are down 17.6% from a year ago. The main issue in 2022 has been declining affordability, with potential buyers getting squeezed by both higher prices and rapidly rising mortgage rates. Unfortunately, 30-year mortgage rates remain a significant headwind and currently sit above 7%, the highest since 2000. Assuming a 20% down payment, the change in mortgage rates and home prices just since December amount to a 76% increase in monthly payments on a new 30-year mortgage for the median new home. Although a lack of inventory has certainly contributed to price gains in the past couple of years, that is no longer as much of a problem. The months’ supply of new homes (how long it would take to sell the current inventory at today’s sales pace) is now 9.2, up significantly from 3.3 early on in the pandemic. While the months’ supply of completed homes is still a relatively low 1.1, the inventory of completed single-family homes has begun to rise quite rapidly as builders finish more units and rising cancellation rates on purchases leave potential buyers with more options. The good news from an affordability perspective is that recent housing data shows that home prices are clearly in a declining trend. Both the national Case-Schiller index and the FHFA index, the latter of which focuses on homes financed with a conforming mortgage, fell in August for the second month in a row and both fell at the fastest pace for any month since 2010-2011. The Case-Shiller index declined 0.9% in August with San Francisco, Seattle, and San Diego leading the drop. However, all twenty major metropolitan areas in the country showed at least some decline in August. Meanwhile, FHFA prices declined 0.7% for the month. Both of these indexes are still up versus a year ago; the Case-Shiller, 13.0%, the FHFA, 11.9%. But don’t expect gains in the next twelve months and we project home prices three to four years from now to be about where they are today. That said, you also shouldn’t expect a very steep 25% peak-to-bottom decline in home prices like in the prior housing bust; more like a 5-10% drop, instead. Why? Because housing is not massively overbuilt like it was at the peak of the housing bubble around 2005-06. On the manufacturing front, the Richmond Fed index, a measure of mid-Atlantic factory sentiment, fell to -10 in October from 0 in September. We will be watching other regional surveys closely to see if weakness is confirmed elsewhere. Also in recent news, the Federal Reserve reported yesterday that the M2 measure of the money supply declined 0.6% in September, the largest drop for any month on record going back to at least 1959. The M2 money supply soared 40.3% in 2020-21, the largest increase for any two years on record. But, so far this year, it’s up at only a 0.1% annual rate. If these recent data are accurate (we have some doubt) and if this slow pace continues for a prolonged period, the economy is in for a very rough time in 2023-24 and inflation, which should remain elevated through 2023, could plummet in 2024.