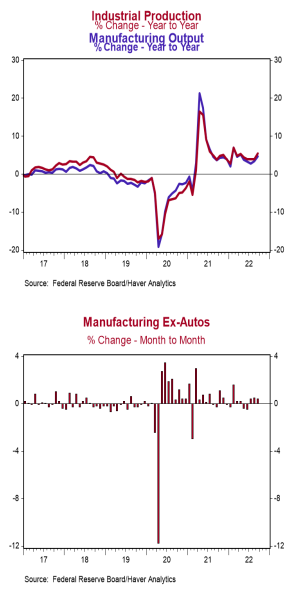

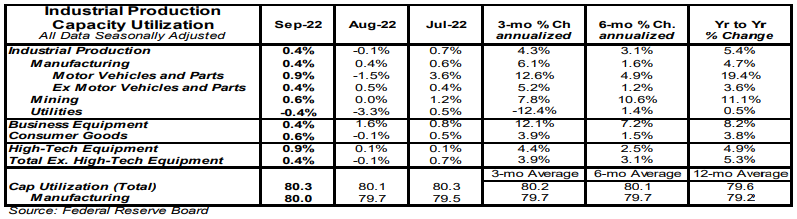

- Industrial production increased 0.4% in September (+0.7% including revisions to prior months), beating the consensus expected gain of 0.1%. Utilities output fell 0.4% in September, while mining rose 0.6%.

- Manufacturing, which excludes mining/utilities, increased 0.4% in September (+0.6% including revisions to prior months). Auto production rose 0.9%, while non-auto manufacturing increased 0.4%. Auto production is up 19.4% in the past year, while non-auto manufacturing is up 3.6%.

- The production of high-tech equipment increased 0.9% in September and is up 4.9% versus a year ago.

- Overall capacity utilization increased to 80.3% in September from 80.1% in August. Manufacturing capacity utilization rose to 80.0% in September from 79.7%.

Implications:

Factory activity surprised to the upside in September, hitting a new record high and signaling that the US economy is not yet in a recession. Moreover, data from prior months were revised up as well adding to the healthy headline gain of 0.4%. Looking at the details, signs of weakness were sparse in September’s report. The utilities sector (which is largely dependent on weather) was the only major category to post a decline, falling 0.4%. Meanwhile, the manufacturing index rose 0.4% with both auto and non-auto activity contributing to the gain. Given the recent trend of Americans shifting their consumption preferences back toward services and away from goods, the resiliency of manufacturing output has been somewhat surprising. That said, production of consumer goods is up 3.8% in the past year while the production of business equipment is up 8.2%. This signals that investment in capital goods might be beginning to drive demand for the manufacturing sector as end-consumers ease up. Notably, capacity utilization in the manufacturing sector hit 80.0% in September, the highest level since 2000! It looks like businesses aren’t just investing in new equipment but making better use of what they already have domestically as well, most likely in response to all the supply chain disruptions over the past several years. Finally, mining posted a gain of 0.6% in September due to an increased pace in extraction of natural gas and other minerals as well as gains in the drilling of new wells. Look for more expansion in the months ahead with oil prices currently still hovering above $80 a barrel incentivizing new exploration. Unfortunately, there is still no sign of the federal government lending a hand on the energy front, even with the political kryptonite of inflation raging. For example, potential reforms to the permitting and the environmental review process for large energy infrastructure projects were recently killed in the Senate and aren’t likely to be revisited until after the midterm elections. Overall, despite the shift back toward services, we expect continued modest gains in industrial production in 2022 as demand continues to outstrip supply. Today’s report puts industrial production 3.4% above pre-pandemic levels. Meanwhile, last week’s report on retail sales shows that after adjusting for inflation, “real” retail sales are up around 13.5% over the same period. This mismatch between supply and stimulus-boosted demand shows why inflation remains uncomfortably high. In other manufacturing news this morning, the Empire State Index, a measure of New York factory sentiment, fell to -9.1 in October from -1.5 in September. We will be watching other regional surveys for any sign of a slowdown.