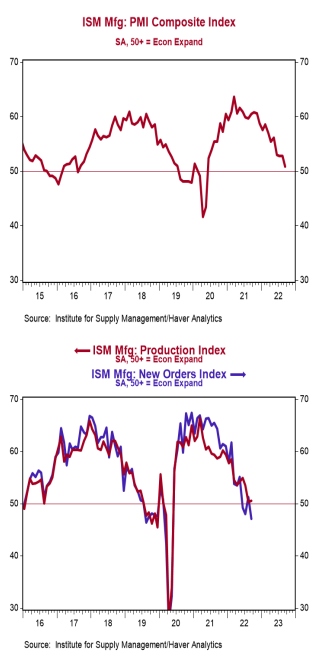

- The ISM Manufacturing Index declined to 50.9 in September, lagging the consensus expected 52.0. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

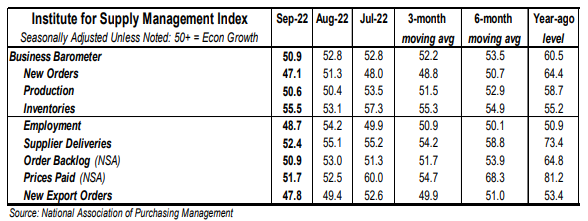

- The major measures of activity were mostly lower in September. The production index rose to 50.6 from 50.4 in August, while the new orders index fell to 47.1 from 51.3. The supplier deliveries index declined to 52.4 from 55.1 in August and the employment index fell to 48.7 from 54.2.

- The prices paid index declined to 51.7 in September from 52.5 in August.

Implications:

The manufacturing sector continued to expand in August, but at the slowest rate since the pandemic recovery began, with only half of the eighteen industries reporting growth. Respondent comments in September continued to highlight supply-chain issues related to shortages of key inputs and labor, but also worries about the pace of future activity with some customers pulling back on new orders due to worries about an economic slowdown. The best news in today’s report was that the pace of production expanded slightly, rising to 50.6 from 50.4 in August. Meanwhile, the new orders index fell back into contraction territory at 47.1 in September, the lowest reading since the early days of the COVID pandemic in 2020. This isn’t much of a surprise given that consumers have been shifting their preferences away from goods and back toward services. However, given that production continues to expand, this should also give US factories time to catch up on all the existing orders they already have in the pipeline. For example, the index for order backlogs fell to 50.9 in September, also the lowest reading since 2020. Meanwhile, pressure on supply chains continued to ease in today’s report as well, with the supplier deliveries index falling for the fifth month in a row and hitting the lowest reading since before the COVID pandemic began. Meanwhile the employment index fell back into contraction at 48.7 in September. While previous weakness in this part of the ISM report has mostly been due to the tight labor market and difficulty in hiring, something that was also echoed in the survey comments multiple times in today’s release, the details show another story. A majority of panelists in September have said they are beginning to take a pause on new hiring, a sign that a weaker outlook for new orders may finally be hurting demand for labor in the US factory sector. Finally, the prices index in today’s report continued to signal that inflation pressures might have peaked, falling for the sixth month in a row to 51.7. In other news this morning, construction spending declined 0.7% in August, with a large drop in home building easily offsetting small gains in sewage/waste disposal projects and construction of recreational facilities.