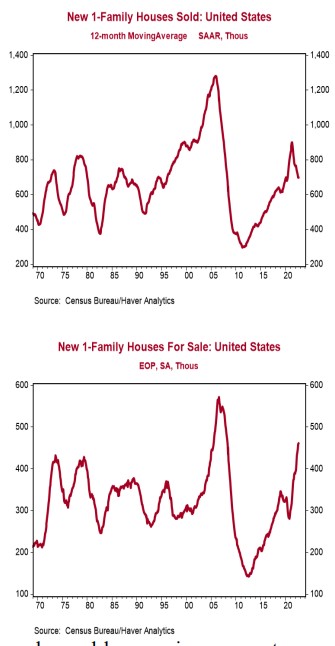

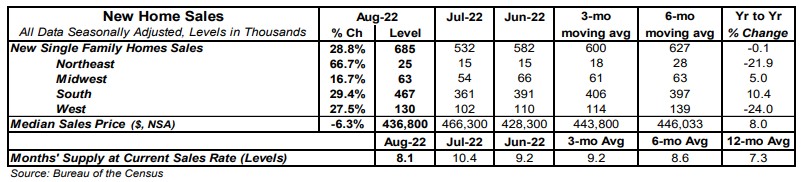

- New single-family home sales increased 28.8% in August to a 0.685 million annual rate, easily beating the consensus expected 0.500 million. Sales are down 0.1% from a year ago.

- Sales in August rose in all major regions.

- The months’ supply of new homes (how long it would take to sell all the homes in inventory) fell to 8.1 in August from 10.4 in July. The drop was entirely due to a faster pace of sales. The inventory of homes rose 2,000 units in August.

- The median price of new homes sold was $436,800 in August, up 8.0% from a year ago. The average price of new homes sold was $521,800, up 11.0% versus last year.

Implications:

New home sales posted the largest monthly gain in more than two years in August, crushing even the most optimistic forecast by any economics group. While the headline gain of 28.8% is a welcome piece of good news, it’s important to remember that new home sales are still down 33.9% from the peak in 2020. That said, today’s report is a sign that sales activity may be beginning to stabilize. The main issue in 2022 has been declining affordability, with potential buyers getting squeezed by both higher prices and rapidly rising mortgage rates. So, it was welcome news that median prices were up only 8.0% from a year ago versus a year-ago comparison of 24.2% in the year ending August 2021. It looks like the relentless upward trend of the past couple of years may be beginning to level off. This was backed up by data out this morning on the top of two home price indexes, both of which showed modest prices in August. National Case-Schiller home prices declined 0.2% in July while FHFA prices, which measure homes financed by conforming mortgages, fell 0.6%. These drops are the largest for any month since 2011, during the last housing bust. Although both of these measures show a substantial increase in home prices in the past year (15.8% for Case-Shiller, 13.9% for FHFA), the following few years should be very different, with roughly unchanged home prices, as rents catch up to home price gains during COVID. Today’s news on home prices finally beginning to ease up is doubly good news because 30-year mortgage rates remain a significant headwind, are surging upwards once again, and currently sit just below 7%. Assuming a 20% down payment, the change in mortgage rates and home prices just since December amount to a 46% increase in monthly payments on a new 30-year mortgage for the median new home. Although a lack of inventory has certainly contributed to price gains in the past couple of years, that should not be as much of a problem going forward. The months’ supply of new homes (how long it would take to sell the current inventory at today’s sales pace) is now 8.1, up significantly from 3.3 early on in the pandemic. Although the months’ supply of completed homes is still a relatively low 0.9, the inventory of completed single-family homes has begun to rise quite rapidly as builders finish more units and rising cancellation rates on purchases leave potential buyers with more options. Meanwhile, builders still have plenty of homes under construction that they will strive to finish in the next several months. That process, generating more finished supply, should help keep downward pressure on new home prices and, in turn, stabilize home sales, as well. This is not the housing bust of the 2000s, a period when home prices and the pace of construction both plummeted for years on end. Finally in manufacturing news this morning, the Richmond Fed index, a measure of mid-Atlantic manufacturing sentiment, rose to 0 in September versus -8.0 in August. We expect to see the national ISM Manufacturing index to remain north of 50, signaling, growth, for the month.