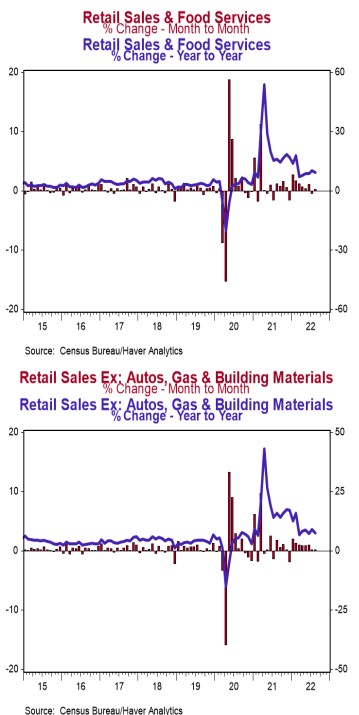

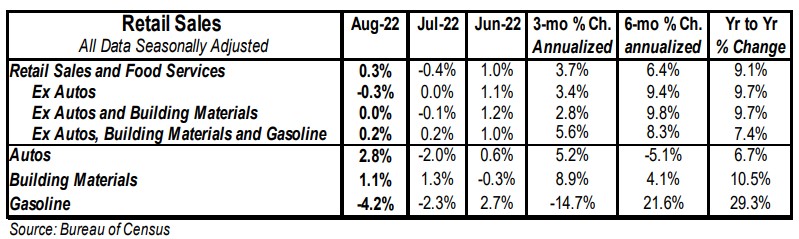

- Retail sales rose 0.3% in August (+0.1% including revisions to prior months). The consensus expected a decline of 0.1%. Retail sales are up 9.1% versus a year ago.

- Sales excluding autos declined 0.3% in August (-0.5% including revisions to prior months) versus a consensus expected no change. These sales are up 9.7% in the past year. Excluding gas, sales rose 0.8% in August and are up 7.4% from a year ago.

- The largest gains in August were for autos and restaurants & bars. The largest declines were gas stations and non-store retailers (internet and mail-order).

- Sales excluding autos, building materials, and gas rose 0.2% in August, but including prior months’ revisions were unchanged. If unchanged in September, these sales will be up at a 5.1% annual rate in Q3 versus the Q2 average.

Implications:

Retail sales rose 0.3% in August, but the underlying details were not as solid as the overall headline number suggests. Prior months’ numbers were revised lower and including revisions retail sales rose a smaller 0.1%. Eight of thirteen retail categories grew in August, led by gains in autos and restaurants & bars, rising 2.8% and 1.1% respectively for the month. The largest declines were for gas stations, which fell by 4.2% reflecting much lower prices at the pump, and non-store retailers, with fell 0.7% in August. “Core” sales, which exclude the most volatile categories of autos, building materials, and gas stations, rose 0.2% in August, but were revised lower for prior months. Still these sales remain up 7.4% from a year ago. The problem is that one of the key drivers of overall spending is inflation. Yes, consumers are spending more, but they are not taking home the same amount of goods. Although retail sales are up 9.1% from a year ago, that pace barely outpaces inflation, with the CPI up 8.3% over the same period. Due to very loose monetary policy and the massive increase in government transfer payments in response to COVID, retail sales are still running much hotter than they would have had COVID never happened. However, loose monetary policy, which helped finance that big increase in government spending, is translating into high inflation, which is why “real” (inflation-adjusted) retail sales are up much less versus a year ago. This doesn’t mean overall consumer spending is down; “real” (inflation-adjusted) spending on services is also still rising. But it does mean overall real consumer spending growth is soft. What to expect in the months ahead? Retail sales will struggle to keep pace with inflation while overall consumer spending increases modestly due to the service sector, as consumers continue to shift their preferences back to services. In other news this morning, import prices fell 1.0% in August while export prices dropped 1.6%. In the past year, import prices are up 7.8%, while export prices are up 10.8%. On the employment front, initial claims for unemployment insurance declined 5,000 last week to 213,000. Continuing claims rose 2,000 to 1.403 million. These figures are consistent with continued healthy job growth in September.