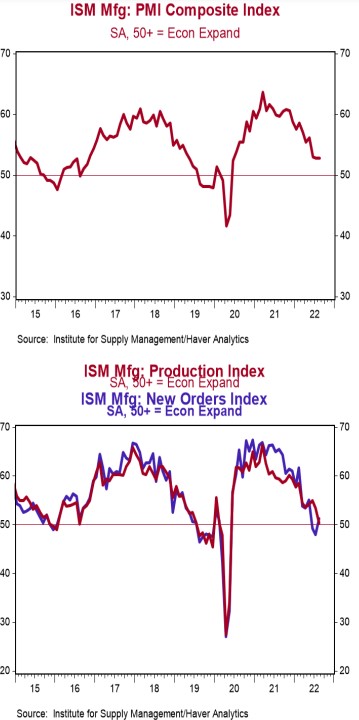

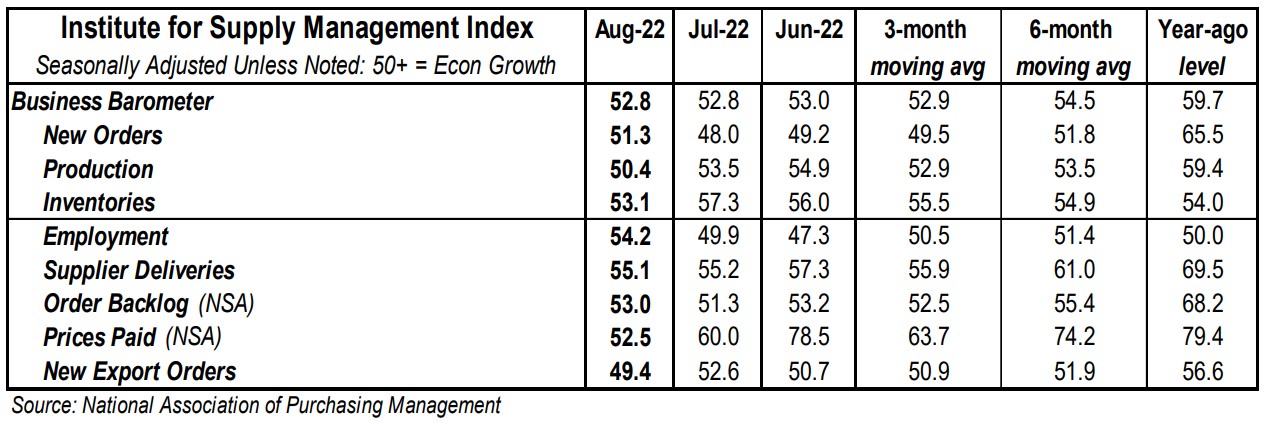

- The ISM Manufacturing Index remained unchanged at 52.8 in August, beating the consensus expected 51.9. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mixed in August. The production index fell to 50.4 from 53.5 in July, while the new orders index rose to 51.3 from 48.0. The supplier deliveries index ticked down to 55.1 from 55.2 in July, and the employment index rose to 54.2 from 49.9.

- The prices paid index declined to 52.5 in August from 60.0 in July.

Implications:

The manufacturing sector continued to expand in August at the same pace as July, with ten of eighteen industries reporting growth. Respondent comments in August continued to highlight supply-chain issues and shortages of key inputs, but also worries about the pace of future activity with some customers reporting high inventory levels. All that said, while the headline index remained unchanged in August, the details of today’s report were healthy. The best news was that the new orders index rose out of contraction territory, hitting 51.3 in August after two consecutive readings below 50. Given that inflation-adjusted consumer spending shows that the actual amount of goods being purchased has been falling since early 2021, the resiliency in new orders is a positive surprise. Ultimately new orders will soften in response to consumers shifting their preferences from goods toward services. However, this should also give US factories time to catch up on all the existing orders they already have in the pipeline. For example, the production index remained in expansion territory at 50.4 in August, signaling factories still have plenty to do. Pressure on supply chains continued to ease in today’s report as well, with the supplier deliveries index falling for the fourth month in a row and hitting the lowest reading since before the COVID pandemic began. Another positive piece of news came from the employment index which jumped back into expansion territory at 54.2 in August, after three months in contraction. It looks like the labor shortage is beginning to ease for manufacturing, with survey responses reporting that it is becoming easier to fill positions and job openings in the sector down from recent record highs. Finally, the prices index in today’s report continued to signal that inflation pressures might have peaked, falling for the fifth month in a row to hit 52.5, the lowest level since the summer of 2020. In other news this morning, construction spending declined 0.4% in July, with a large drop in home building easily offsetting gains in highway and street construction and commercial projects. On the employment front, initial claims for unemployment insurance declined 5,000 last week to 232,000. Meanwhile, continuing claims rose by 26,000 to 1.438 million. These figures suggest another month of solid job growth in August. On the housing front, the top two home price indexes both show that June had the smallest monthly gains since mid-2020. Case-Schiller home prices rose 0.3% while FHFA prices, which measure homes financed by conforming mortgages, increased only 0.1%, an abrupt and sharp deceleration for each. Although both of these measures show a substantial increase in home prices in the past year (18.0% for Case-Shiller, 16.2% for FHFA), the following few years should be very different, with roughly unchanged home prices, as rents catch up to home price gains during COVID.