View from the Observation Deck

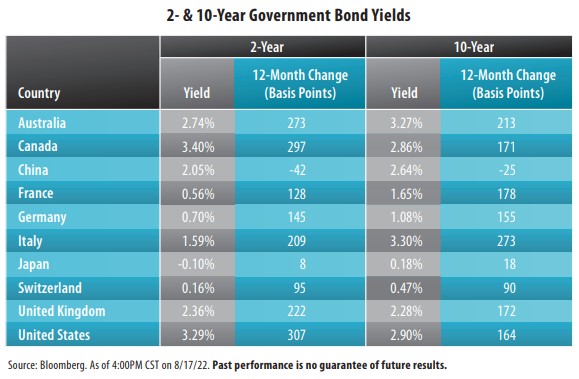

1. Today's blog post shows the yields on a couple of benchmark government bond maturities from key countries/economies around the globe.

2. While bond yields are up from their historic lows, in many instances, they remain depressed.

3. The yield on the U.S. 10-year Treasury Note (T-note) stood at 2.90% on 8/17/22, 239 basis points (bps) higher than its all-time closing low of 0.51% on 8/4/20 (not in table), but 103 basis points below its 3.93% average yield for the 30-year period ended 8/17/22 (not in table), according to Bloomberg.

4. The yield on the U.S. 2-year T-note stood 39 basis points higher than the yield on the 10-year T-note at the close on 8/17/22, which means the yield curve is inverted. Over the past 30 years, the average yield on the 10-year T-note exceeded that of the 2-year T-note by 112 basis points, according to Bloomberg.

5. As of 8/17/22, the federal funds target rate (upper bound) stood at 2.50%, just above its 30-year average of 2.46%. The Federal Reserve ("Fed") hiked rates by 75 basis points in June and July, the fastest pace since 1994. It has signaled that future increases will be data dependent. At the moment, the Fed characterizes inflation as “uncomfortably” high.

6. Due to its zero-COVID policy and real estate crisis, China just cut its key lending rate in an effort to shore up growth.

7. With the rise in government bond yields throughout much of the globe over the past year, the amount of negative-yielding debt has declined significantly, as measured by the Bloomberg Global Aggregate Negative Yielding Debt Index. The total value stood at $2.60 trillion on 8/17/22, down from $16.57 trillion a year ago.

8. We will continue to monitor the situation to see if high inflation plus any tapering the Fed does to its balance sheet of assets is enough to push bond yields higher in the months ahead.