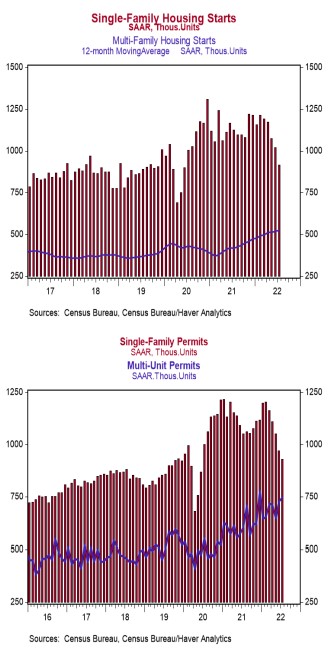

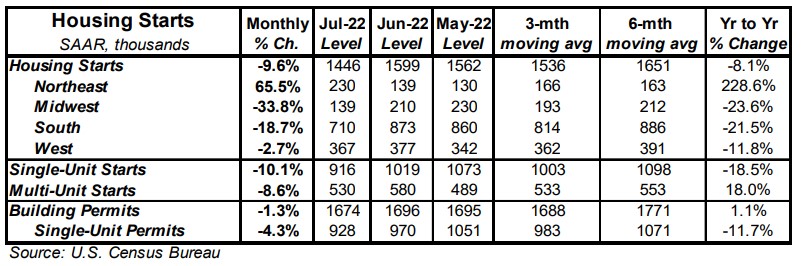

- Housing starts declined 9.6% in July to a 1.446 million annual rate, well below the consensus expected 1.527 million. Starts are down 8.1% versus a year ago.

- The drop in July was due to both single-family and multi-unit starts. In the past year, single-family starts are down 18.5% while multi-unit starts are up 18.0%.

- Starts in July fell in the Midwest, South and West, but rose in the Northeast.

- New building permits fell 1.3% in July to a 1.674 million annual rate, beating the consensus expected 1.640 million. Compared to a year ago, permits for single-family homes are down 11.7% while permits for multi-unit homes are up 23.5%.

Implications:

Housing starts fell to the slowest pace in seventeen months in July as builders continued to navigate relatively high mortgage rates, labor shortages, and ongoing supply-chain issues. Looking at the details, single-family construction fell 10.1% in July, hitting the slowest pace in more than two years, leading the drop in overall starts. Meanwhile, multi-unit starts fell 8.6%. It is clear developers are becoming more cautious about future demand for new single-family projects with 30-year mortgage rates hovering around 5.5% and are continuing to focus resources on apartment buildings instead. Over the past year single-family starts are down 18.5% versus multi-unit starts, which are up 18.0%. The good news is that 30-year mortgage rates have begun to moderate and are down about half a percentage point from the peak in June, although still up two percentage points from the recent bottom. It also makes sense for builders to slow down the pace of starts given how many projects are currently sitting in the pipeline. The number of homes already under construction remains near the highest levels on record back to 1970. Moreover, the gap between the number of units under construction and the number of completions remains at record levels back to the 1970s, as well. These figures illustrate a slower construction process due to a lack of workers and other supply-chain difficulties. In this context, it’s not surprising to see new building permits decline 1.3% in July. The backlog of projects that have been authorized but not yet started is currently at a record high since the series began back in 1999. Meanwhile, homebuilder sentiment, as measured by the NAHB Housing Index, is clearly deteriorating. The index fell for an eighth consecutive month to 49 in August, the worst streak since the lead up to the housing market collapse. The index now below 50, signals that more builders view conditions as poor vs. good, the first time since May 2020 during the height of COVID. The prime concern continues to be higher mortgage rates, which are having a negative impact on potential sales as certain buyers are at least temporarily priced out of the market, leaving some builders with a surplus of inventory.