- Personal income rose 0.6% in June, beating the consensus expected +0.5%. Personal consumption rose 1.1% in June, versus a consensus expected +1.0%. Personal income is up 5.7% in the past year, while spending has increased 8.4%.

- Disposable personal income (income after taxes) increased 0.7% in June and is up 3.3% from a year ago.

- The overall PCE deflator (consumer prices) rose 1.0% in June and is up 6.8% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.6% in June and is up 4.8% in the past year.

- After adjusting for inflation, “real” consumption rose 0.1% in June, and is up 1.6% from a year ago.

Implications:

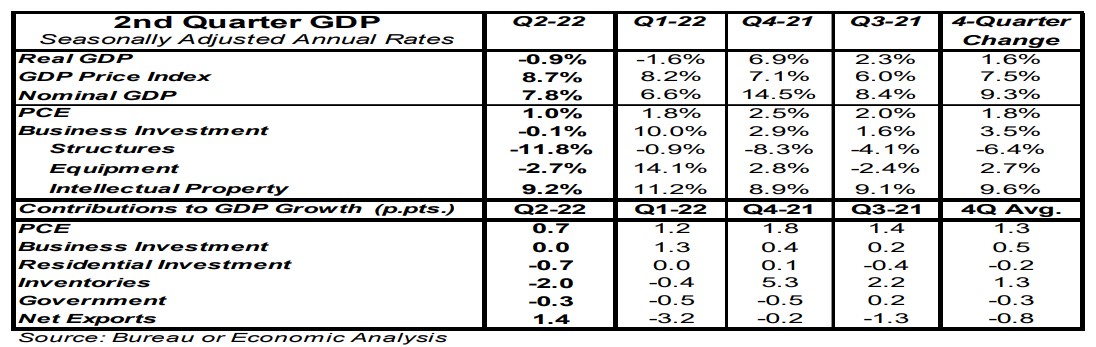

Consumers continue to spend at a healthy pace, but inflation is eating away at what they get for their dollars. While activity moved broadly higher in June, the best news in today’s report was the 0.6% rise in personal income, where private sector wages and salaries led the way (+0.5% in June) while government transfer payments were flat. Compared to a year ago, personal income is up 5.7%, lagging the 6.8% rise in inflation of the same period. However, the headline income number hides an important transition. Strip out government transfer payments – the economic morphine that Washington used to cover up the pain of bad COVID policies – and personal income is up 8.1% in the past year, with private-sector wages and salaries up a massive 11.2% over the same period. Consumption, meanwhile, rose 1.1% in June and is up 8.4% from a year ago. Diving into the details of today’s report shows that spending was led by goods, where rising prices at the pump pushed spending on gasoline and other energy goods up 9.7% in June. Spending on services rose 0.8% in June and is up 9.2% from a year ago, and we expect growth in services spending will outpace goods in the coming months as the continued recovery from COVID restrictions has people back outside and returning to the leisure and travel activities they avoided throughout much of 2020 and 2021. Since bottoming in April of 2020, consumption has grown at an astronomical 17.8% annual rate and today stands 15.9% above February 2020 levels. But artificially booming demand, the result of government transfers and rapid growth in the M2 money supply, is not a free lunch. PCE prices, the Fed’s preferred measure of inflation, rose 1.0% in June, and are up 6.8% from a year ago. Core prices, which exclude food and energy, rose 0.6% in June and are up 4.8% from a year ago, neither anywhere close to the Federal Reserve’s 2.0% target. The Fed has a tough road ahead in combating the inflation created by policy mistakes over the last two years, and it doesn’t help that they put themselves behind the curve by denying that they needed to act until it was simply impossible to ignore any longer. We were not in a recession in the first half of 2022, but the odds of the Fed avoiding one aren’t much better than the Chicago Cubs chances to win the World Series. In recent manufacturing news, the Kansas City Fed index, a measure of manufacturing sentiment in that region, rose to 13 in July from 12 in June. Also on the manufacturing front, the Chicago PMI declined to 52.1 in July from 56.0 in June. Expect a decline in the national ISM Manufacturing index reported Monday but for the index to remain north of 50, signaling growth.