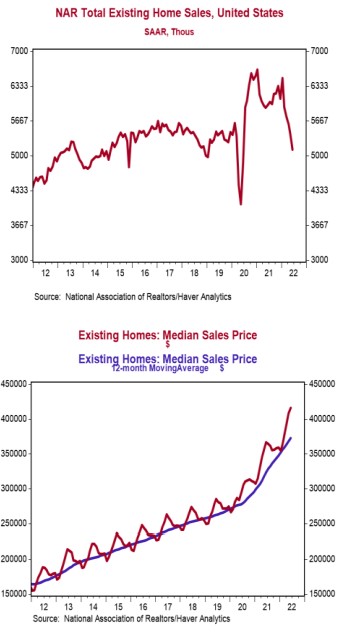

- Existing home sales declined 5.4% in June to a 5.120 million annual rate, below the consensus expected 5.350 million. Sales are down 14.2% versus a year ago.

- Sales in June fell in the West, South and Midwest, but remained unchanged in the Northeast. The drop was due to both single-family homes and condos/co-ops.

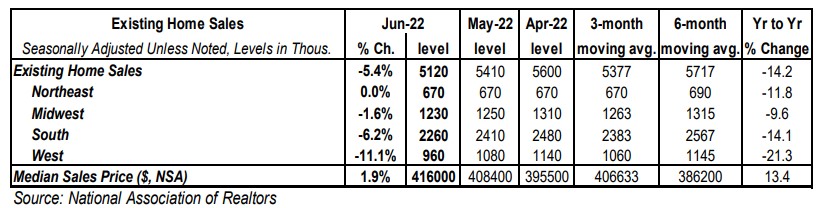

- The median price of an existing home rose to $416,000 in June (not seasonally adjusted) and is up 13.4% versus a year ago.

Implications:

Existing home sales fell for the fifth month in a row in June, posting the longest streak of declines since 2013. Recent volatility shows that the housing market is struggling to find its footing so far in 2022, with falling affordability playing a major role. The prime culprit recently has been 30-year mortgage rates, which have already risen more than 200 basis points since December and are now hovering just below 6%, the highest level since 2008. Even more notable than the decline in sales in today’s report is that despite surging mortgage rates median prices are still climbing, posting a fifth consecutive monthly gain in June. Part of this is just seasonality (prices typically rise heading into the summer buying season), and median price growth in the past year has slowed to 13.4% from a peak of 25.2% in May 2021, but the “reverse wealth effect” the Federal Reserve has been looking for has yet to show up in the housing market. Assuming a 20% down payment, the rise in mortgage rates and home prices since December amount to a 56% increase in monthly payments on a new 30-year mortgage for the median existing home. No wonder sales have slowed down! One piece of good news in today’s report is that the inventory of existing homes on the market has begun to rise relatively rapidly, and is now up 2.4% from a year ago, the best way to look at the data given the seasonality of the housing market. Notably, this is the first annual increase we have seen in housing inventory since May of 2019. Meanwhile the months’ supply of existing homes for sale (how long it would take to sell today’s inventory at the current sales pace) rose to 3.0 months in June, the highest level in nearly two years. While this represents much needed progress, it’s important to note that inventory still remains low from a historical perspective. What is really impressive is that despite the lack of options demand remains strong, with buyer urgency so high in June that 88% of existing homes sold were on the market for less than a month. While sales are clearly under pressure, this is not a repeat of 2007-09. We do not foresee a widespread collapse in home sales even with higher mortgage rates, though it is likely that existing home sales wind up lower in 2022 than 2021. More inventory is finally becoming available, which will help price gains moderate further.