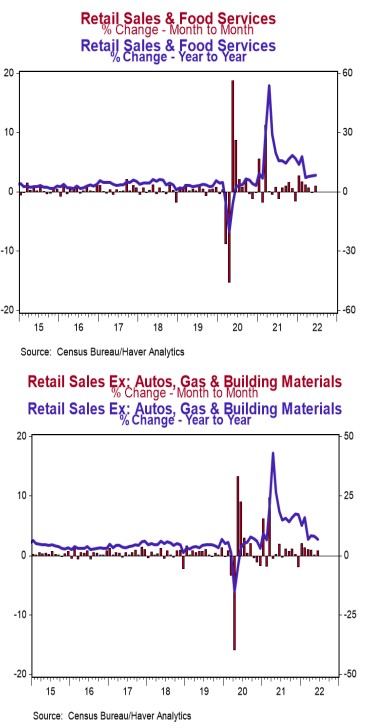

- Retail sales rose 1.0% in June (+1.1% including revisions to prior months) narrowly beating the consensus expected gain of 0.9%. Retail sales are up 8.4% versus a year ago.

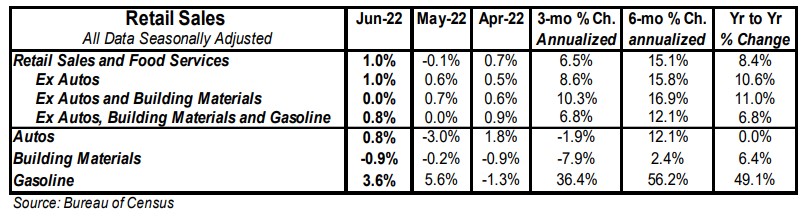

- Sales excluding autos rose 1.0% in June (+1.1% including revisions to prior months), beating the consensus expected gain of 0.7%. These sales are up 10.6% in the past year. Excluding gas, sales rose 0.7% in June and are up 5.1% from a year ago.

- The increase in sales in June was led by gas stations, non-store retailers (internet and mail-order), and autos. The largest decline was in building materials.

- Sales excluding autos, building materials, and gas rose 0.8% in June, but including prior months’ revisions were up 0.7%. These sales were up at an 8.9% annual rate in Q2 versus the Q1 average.

Implications:

Retail sales grew at what would normally be a robust pace in June, but, at least for this particular sector, sales are not keeping pace with inflation. Retail sales grew 1.0% in June and were revised up for May, with nine of the thirteen major sales categories rising in June, led by gas stations, non-store retailers, and autos. “Core” sales, which exclude the most volatile categories of autos, building materials, and gas stations, rose 0.8% in June, are up 6.8% from a year ago, and up 26.8% versus February 2020. But, again, the problem is that one of the key drivers of overall spending is inflation. Yes, consumers are spending more, but they are not taking home the same amount of goods. Adjusted for the consumer price index (CPI), retail sales declined 0.3% in June. Although retail sales are up 8.4% from a year ago, that pace lags inflation, with the CPI up 9.1% over the same period. Due to very loose monetary policy and the massive increase in government transfer payments in response to COVID, retail sales are still running much hotter than they would have had COVID never happened. However, loose monetary policy, which helped finance that big increase in government spending, is translating into high inflation, which is why “real” (inflation-adjusted) retail sales are down versus a year ago. This doesn’t mean overall consumer spending is down, because “real” (inflation-adjusted) spending on services is still rising. But it does mean overall real consumer spending growth is soft. What to expect in the months ahead? Continued gains in retail sales, but gains that struggle to keep pace with inflation. Meanwhile, look for modest overall gains in consumer spending due to the service sector as consumers continue to shift their preferences back to services. In other news this morning, import prices rose 0.2% in June while export prices increased 0.7%. In the past year, import prices are up 10.7%, while export prices are up 18.2%. More signs monetary policy was too loose for way too long.