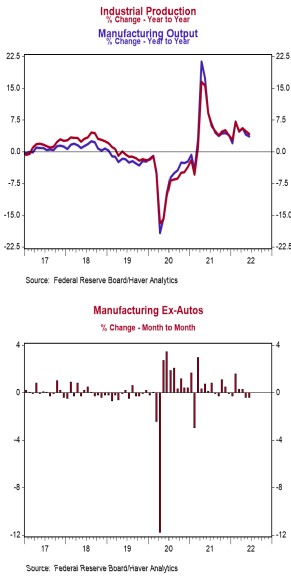

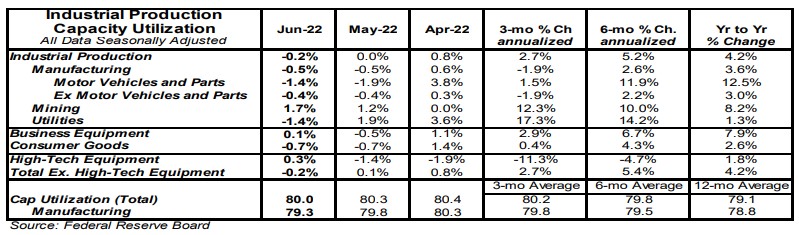

- Industrial production declined 0.2% in June (-0.8% including revisions to prior months), below the consensus expected gain of 0.1%. Utilities output fell 1.4% in June, while mining increased 1.7%.

- Manufacturing, which excludes mining/utilities, declined 0.5% in June (-1.2% including revisions to prior months). Auto production fell 1.4%, while non-auto manufacturing fell 0.4%. Auto production is up 12.5% in the past year, while non-auto manufacturing is up 3.0%.

- The production of high-tech equipment increased 0.3% in June and is up 1.8% versus a year ago.

- Overall capacity utilization fell to 80.0% in June from 80.3% in May. Manufacturing capacity utilization fell to 79.3% in June from 79.8%.

Implications:

Following five straight months of expansion, industrial production took a breather in June. While the headline decline was 0.2%, and data for prior months were revised down, it’s important to note that industrial production still rose at a healthy 6.2% annualized rate in Q2, which strongly suggests we are not in a recession. Looking at the details, the main culprit behind today’s decline was the manufacturing sector, which posted a second consecutive monthly drop of 0.5%. Both auto and non-auto manufacturing contributed to the decline. Today’s report also illustrated the ongoing trend of Americans shifting their consumption preferences back towards services and away from goods, which seems to be leading factories to taper back production. For example, US factory output of consumer goods fell 0.7% for the second consecutive month in June. The utilities sector, which is volatile from month to month and largely dependent on weather, was the other source of weakness in today’s report, falling 1.4%. Meanwhile, the mining sector (think oil rigs in the Gulf) continued to expand production, rising 1.7% in June, though the index remains below pre-pandemic levels. We expect continued gains from this sector in the months ahead with oil prices currently still hovering around $100 a barrel incentivizing new exploration. Unfortunately, there is still no sign of the federal government lending a hand on the energy front, even with the political kryptonite of inflation raging. For example, the Biden Administration continues to blame high prices at the pump on price gouging rather than offering regulatory relief or approving new leases to help spur additional production. The good news is that capacity continues to come back online despite this, with Baker Hughes reporting that the total number of oil and gas rigs in operation in the US is rapidly approaching pre-pandemic levels. Overall, despite the shift back towards services, we expect continued gains in industrial production in 2022 as demand continues to outstrip supply. For example, this report puts industrial production 2.7% above pre-pandemic levels. Meanwhile, the report out this morning on retail sales showed that even after adjusting for inflation, “real” retail sales are up 13.4% over the same period. This mismatch between supply and stimulus-boosted demand exemplifies why inflation remains uncomfortably high. In other manufacturing news this morning, the Empire State Index, a measure of New York factory sentiment, jumped unexpectedly to +11.1 in July from -1.2 in June.