View from the Observation Deck

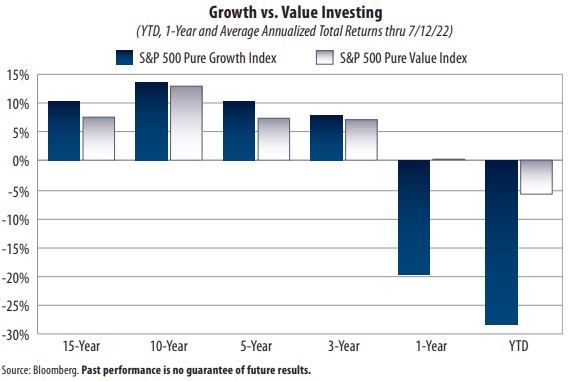

1. We update this post every few months so that investors can see which of the two styles (growth or value) are delivering the better results.

2. The most recent results show that value stocks have significantly outperformed growth stocks on a 1-year and year-to-date basis.

3. Having said that, the S&P 500 Pure Growth Index outperformed its value counterpart in four of the six periods featured in the chart above.

4. The total returns through 7/12/22 were as follows (Pure Growth vs. Pure Value): 15-year avg. annual (10.28% vs. 7.52%); 10-year avg. annual (13.54% vs. 12.93%); 5-year avg. annual (10.22% vs. 7.33%); 3-year avg. annual (7.74% vs. 7.06%); 1-year (-19.98% vs. 0.03%); and year-to-date (-28.76% vs. -5.93%).

5. As of 6/30/22, the largest sector weighting in the S&P 500 Pure Growth Index was Information Technology at 35.5%, according to S&P Dow Jones Indices. The largest sector weighting in the S&P 500 Pure Value Index was Financials at 30.3%.

6. From 12/31/21 through 7/12/22 (YTD), the S&P 500 Information Technology Index posted a total return of -25.63%, compared to -18.26% for the S&P 500

Financials Index, according to Bloomberg. The S&P 500 Index was down 19.22% over the same period.

7. At a combined weighting of 26.6%, the S&P 500 Pure Value Index's exposure to Energy, Utilities and Consumer Staples was significantly higher than the 9.6%

combined weighting in the S&P 500 Pure Growth Index as of 6/30/22, according to S&P Dow Jones Indices. They are the three best-performing sectors, and the only sectors in positive territory, so far in 2022.

8. From 12/31/21 through 7/12/22 (YTD), the S&P 500 Energy, Utilities and Consumer Staples Indices posted total returns of 26.56%, -0.83% and -5.08%, respectively, according to Bloomberg.

9. Value stocks have tended to outperform growth stocks when the yield on the benchmark 10-year Treasury note (T-note) rises, and vice versa. For the 12- onth period ended 7/12/22, the yield on the 10-year T-note rose 160 basis points to 2.97%, according to Bloomberg.