View from the Observation Deck

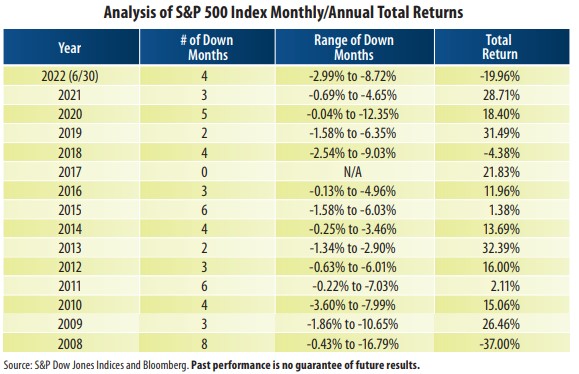

1. In 2017, the S&P 500 Index ("index") did not register a single down month on a total return basis, which includes reinvested dividends. That is not typically the case.

2. In 13 of the past 14 calendar years (2008-2021), which includes the 2008-2009 financial crisis, the index endured no less than two negative total return months and as many as eight (see table).

3. In 2022, the S&P 500 Index has endured four down months (January, February, April and June), according to S&P Dow Jones Indices.

4. In 2020, there were five down months and the -12.35% total return posted in March marked the largest monthly decline for any year in the table following 2008. Despite the five down months, the index posted a total return of 18.40%.

5. From 2008 through June 2022, the S&P 500 Index endured a loss in 57 of the 174 months on a total return basis, or approximately 32.8% of the time. Over that same period, the index posted an average annualized total return of 8.95%, according to Bloomberg.

6. For comparative purposes, from 1926 through 2021, the S&P 500 Index posted a loss in 25 of the 96 calendar years on a total return basis, or approximately 26.0% of the time, according to data from Ibbotson Associates/Morningstar. Over that same period, the index posted an average annual total return of 10.46%.

7. Stock prices don't rise in a straight line. Investors are going to encounter some turbulent times along the way. Remember, the S&P 500 Index has never failed to fully recoup any losses sustained from corrections or bear markets over time.

8. A Bloomberg survey of 23 equity strategists found that their average 2022 year-end price target for the S&P 500 Index was 4,617 as of 6/15/22, down from 4,743 on 5/18/22 (23 strategists surveyed), according to its own release. The highest and lowest estimates were 5,330 (unchanged) and 3,900 (unchanged), respectively. The index closed trading on 7/6/22, at 3,845.08.

9. Brian Wesbury, Chief Economist at First Trust Advisors L.P., announced on 5/9/22, that he is looking for a 2022 year-end price target of 4,900, down from his original forecast of 5,250 at the start of the year.