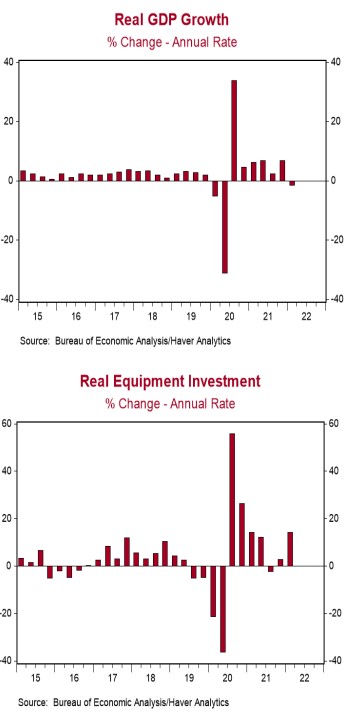

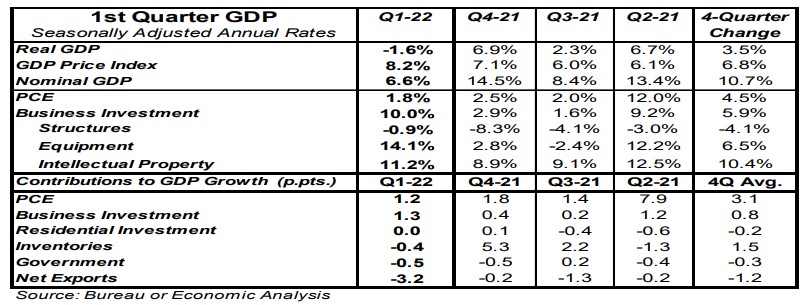

- Real GDP growth in Q1 was revised slightly lower to a -1.6% annual rate from a prior estimate and consensus expected -1.5%.

- A downward revision to personal consumption more than offset an upward revision to inventories.

- The largest positive contributions to the real GDP growth rate in Q1 were business fixed investment and personal consumption. The weakest component, by far, was net exports.

- The GDP price index was revised up to an 8.2% annual growth rate from a prior estimate of 8.1%. Nominal GDP growth – real GDP plus inflation – was revised up to a 6.6% annual rate from a prior estimate of 6.5%.

Implications:

Real GDP shrank at a 1.6% annual rate in the first quarter, but this does not indicate a recession. Real gross domestic income (Real GDI), an alternative measure of economic activity that is just as accurate, was up at a 1.8% rate. The problem with GDI data is that the first report doesn't arrive until one month after the GDP data, so very few people pay attention. Closing the case against a recession in Q1 is that industrial production and jobs rose rapidly while unemployment fell. The best news in today's report was that economy-wide corporate profits were revised up slightly for Q1, mostly due to profits at domestic nonfinancial companies. The worst news was that GDP prices were revised up, with inflation at an 8.2% annual rate versus a prior estimate of 8.1%. In other recent news, yesterday the Federal Reserve reported that the M2 measure of the money supply grew only 0.1% in May and is up a relatively moderate 6.6% from a year ago. The economy still has to absorb the massive increase in M2 in 2020-21, which means high inflation for at least the next few years. But, at least for now, the Fed has reduced the pace of money growth so that, if it maintains this lower pace, inflation can eventually return to lower levels. On the housing front, rapid price gains continued in April. The FHFA index increased 1.6% in April and is up 18.8% from a year ago. The national Case-Shiller index rose 1.5% for the month and is up 20.4% versus a year ago. In the past year, price gains have been led by Tampa, Miami, Phoenix, and Dallas, with the slowest gains in Minneapolis, Washington, DC, and Chicago. Look for much more modest price gains by year end and close to flat national average home prices in the following couple of years. In other housing news, pending home sales, which are contracts on existing homes, rose 0.7% in May, overcoming the headwind of higher mortgage rates. For the factory sector, the Richmond Fed index, a measure of mid-Atlantic manufacturing sentiment, fell to -11 in June versus -9 in May. Plugging this into our models suggests a decline in the national ISM index for June, but that the index should remain solidly above 50, signaling growth.