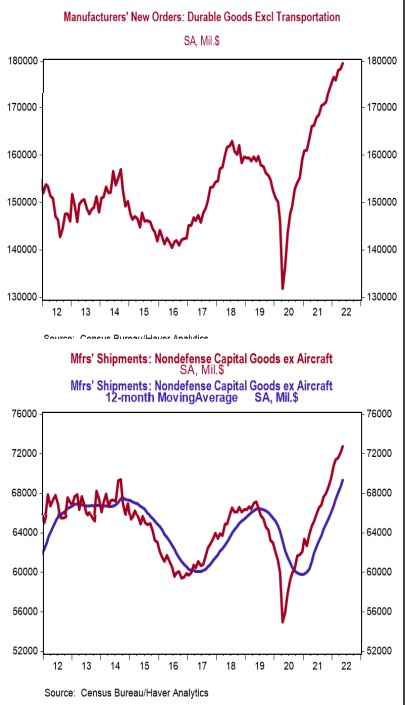

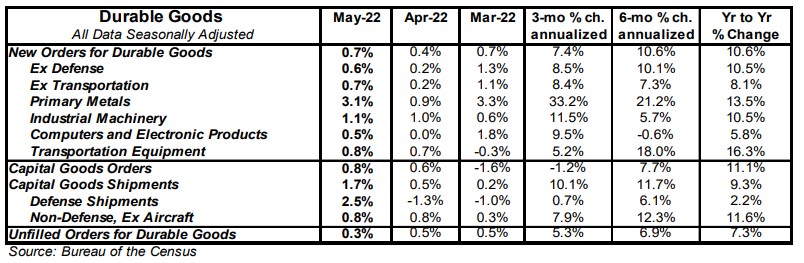

- New orders for durable goods rose 0.7% in May (+0.6% including revisions to prior months), beating the consensus expected 0.1%. Orders excluding transportation also increased 0.7% in May, beating the consensus expected gain of 0.3%. Orders are up 10.6% from a year ago, while orders excluding transportation are up 8.1%.

- The rise in orders in May was led by primary metals, machinery, and defense aircraft.

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure increased 0.8% in May. If unchanged in June, these orders will be up at a 7.5% annualized rate in Q2 versus the Q1 average.

- Unfilled orders rose 0.3% in May and are up 7.3% in the past year.

Implications:

New orders for durable goods beat consensus expectations in May, with strength across almost all major categories. With intense scrutiny of every data point on the strength of businesses and consumers, today's surprise to the upside combats concerns that the U.S. economy is already in (or teetering on the precipice of) a recession. We still have a month to wait before we get our first look at second quarter GDP, and while growth will likely not prove stellar, we don't think it will decline, either. The underlying details of the durables report showed orders activity was largely positive, with primary metals and industrial machinery the standouts. Defense aircraft and auto orders rose in May but were partially offset by a decline in orders for commercial airplanes. The transportation sector is notoriously volatile month-to-month, but stripping that out shows orders still grew 0.7% in May. Beyond the rise in orders for primary metals (+3.1%) and machinery (+1.1%), orders grew at a healthy clip for computers and electronic products (+0.5%). Orders for fabricated metals products were unchanged in May while electrical equipment saw orders tick down 0.9%. Further back in the process, unfilled orders continue to rise, suggesting activity will remain positive as companies battle to keep up with demand that has far outpaced supply. One of the most important pieces of today's report, shipments of "core" non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), rose 0.8% in May following a 0.8% increase in April. If unchanged in June, these orders will be up at a 7.5% annualized pace in Q2 versus the Q1 average, and will provide a tailwind to second quarter GDP growth, which is currently tracking around 2% annualized growth following the Q1 GDP decline. Orders for durable goods have recovered sharply, up 67.9% since the April 2020 bottom and now sit 15.4% above the pre-pandemic high set in February 2020. We expect business investment will remain a tailwind for GDP growth throughout 2022 as companies continue to reopen and recover from the severe economic consequences of the COVID shutdowns.