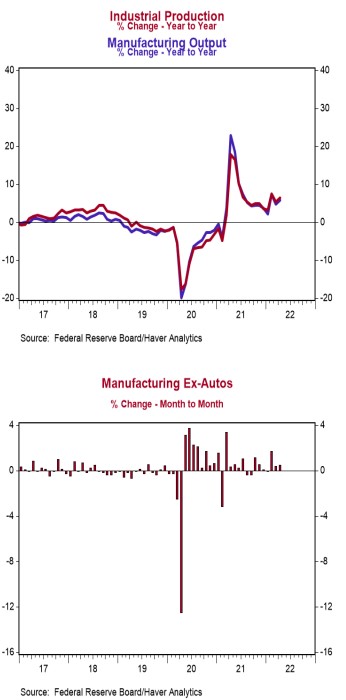

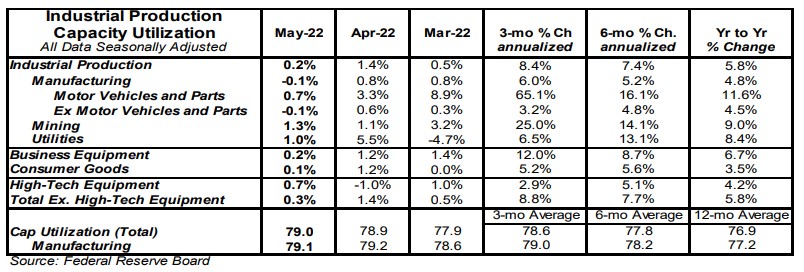

- Industrial production increased 0.2% in May (+0.1% including revisions to prior months), below the consensus expected gain of 0.4%. Utilities output rose 1.0% in May, while mining increased 1.3%.

- Manufacturing, which excludes mining/utilities, declined 0.1% in May. Auto production rose 0.7%, while non-auto manufacturing fell 0.1%. Auto production is up 11.6% in the past year, while non-auto manufacturing is up 4.5%.

- The production of high-tech equipment increased 0.7% in May and is up 4.2% versus a year ago.

- Overall capacity utilization rose to 79.0% in May from 78.9% in April. Manufacturing capacity utilization fell to 79.1% in May from 79.2%.

Implications:

Industrial activity continued its V-shaped recovery in May, rising for the fifth month in a row, though by less than consensus expectations. Looking at the details, today's report was a mixed bag. While overall industrial production posted a gain, the manufacturing sector reported a small decline in activity in May. This was driven by manufacturing outside the auto sector where activity fell 0.1%, which more than offset the 0.7% increase in auto manufacturing. While it's too early to tell in the data, there has been a trend recently with Americans shifting their consumption preferences back towards services and away from goods, which could ultimately lead factories to taper back production. Meanwhile, the mining sector (think oil rigs in the Gulf) continued to make strong progress, rising 1.3% in May. We expect continued gains from this sector in the months ahead, with oil prices currently above $110 a barrel, incentivizing new exploration. Unfortunately, there is still no sign of the federal government lending a hand on the energy front, even with the political kryptonite of inflation raging. For example, the Biden Administration recently blamed high prices at the pump on price gouging rather than offering regulatory relief or approving new leases to help spur along additional production. The good news is that capacity continues to come back online despite this, with Baker Hughes reporting that the total number of oil and gas rigs in operation in the US is rapidly approaching pre-pandemic levels. Finally, the utilities sector, which is volatile from month to month and largely dependent on weather, rose 1.0% in May. Overall, despite the shift back towards services, we expect a continued upward trend in industrial production in 2022 with demand continuing to outstrip supply. For example, this report puts industrial production 4.3% above pre-pandemic levels. Meanwhile, the report out earlier this week on retail sales showed that even after adjusting for inflation, "real" retail sales are up 13.6% over the same period. Ongoing issues with supply chains and labor shortages are hampering a more robust rise in activity, with job openings in the manufacturing sector currently at a record high and more than double pre-pandemic levels. This mismatch between supply and demand shows why inflation remains uncomfortably high.