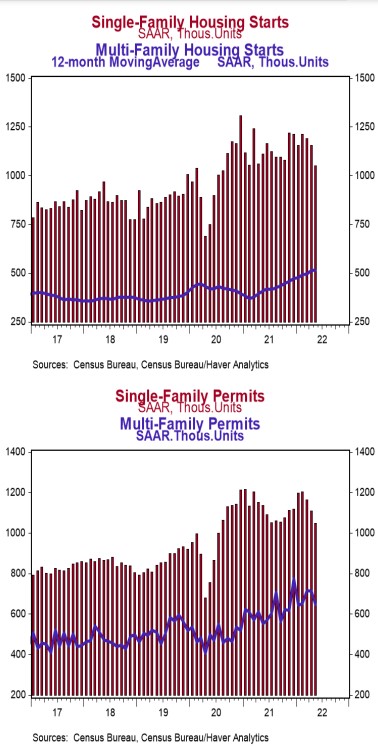

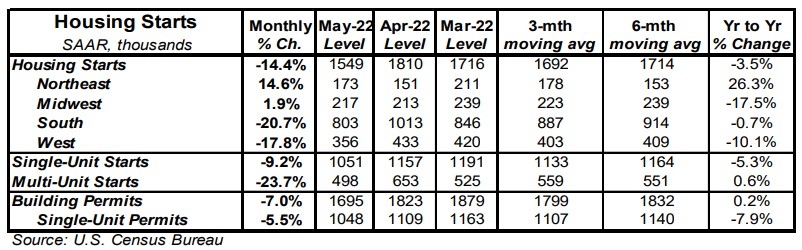

- Housing starts declined 14.4% in May to a 1.549 million annual rate, well below the consensus expected 1.701 million. Starts are down 3.5% versus a year ago.

- The drop in May was due to both single-family and multi-unit starts. In the past year, single-family starts are down 5.3% while multi-unit starts are up 0.6%.

- Starts in May fell in the South and West but rose in the Northeast and Midwest.

- New building permits fell 7.0% in May to a 1.695 million annual rate, below the consensus expected 1.778 million. Compared to a year ago, permits for single-family homes are down 7.9% while permits for multi-unit homes are up 17.0%.

Implications:

Housing starts posted the largest monthly decline since the early days of the pandemic in May as builders continued to navigate a challenging housing market characterized by the highest mortgage rates since 2008, labor shortages, and ongoing supply-chain issues. That said, part of today's 14.4% headline decline was the result of April's reading on construction being revised up to the highest level since 2006. Without that upward revision, May's decline would have been a more modest (though still significant) 10.2%. Looking at the details, both single-family and multi-unit construction contributed to the drop in May. It's clear developers are becoming more cautious about future demand for new projects with 30-year mortgage rates nearing 6%. However, it also makes sense to slow down the pace of starts given how many projects are currently sitting in the pipeline. The number of homes already under construction is at the highest level on record back to 1970. Moreover, the gap between the number of units under construction and the number of completions of new homes remains at record high levels back to 1970s as well. These figures illustrate a slower construction process due to a lack of workers and other supply-chain difficulties. In this context, it's not surprising to see new building permits fall 7.0% in May. The backlog of projects that have been authorized but not yet started is currently sitting just below the record high since the series began back in 1999. With plenty of future building activity waiting to get underway as other projects are finished, and given that residential investment is counted in GDP when units are completed, housing can continue to be a tailwind for economic growth even with a slowdown in the headline pace of housing starts given current conditions. Builders are still looking to boost the near record-low levels of inventory to satisfy buyers, and as Millennials continue to enter the housing market as the now largest living generation. In other recent housing news, the NAHB Housing Index, which measures homebuilder sentiment, declined to 67 in June from 69 in May. While this reading remains elevated from a historical standpoint, it is clear supply-chain issues and rising mortgage rates are continuing to have a negative impact, which has pushed this index to a two-year low. In other news this morning, initial unemployment claims fell 3,000 last week to 229,000. Meanwhile, continuing claims rose 3,000 to 1.312 million. Overall, these figures are consistent with continued growth in jobs in June. Finally, in manufacturing news this morning, the Philadelphia Fed Index, a measure of factory sentiment in that region, fell to -3.3 in June from +2.6 in May.