View from the Observation Deck

1. Equities moved into bear market territory as of yesterday’s close, as measured by the S&P 500 Index. A bear market is defined as a 20.00% or greater decline in the price of a security or index from its recent peak.

2. YTD-6/13/22, the S&P 500 Index posted a total return of -20.79%, according to Bloomberg.

3. Investors who follow the financial media have been told by the likes of traders and hedge fund managers for years that buying and holding stocks no longer works.

4. The notion that investors are vulnerable to surrendering gains achieved over time to negative events, such as wars, inflation and the occasional black swan, is misguided, in our opinion. While nothing is guaranteed with respect to the performance of equities, the fact is, up until this point, the S&P 500 Index has never failed to fully recover the losses sustained in a bear market.

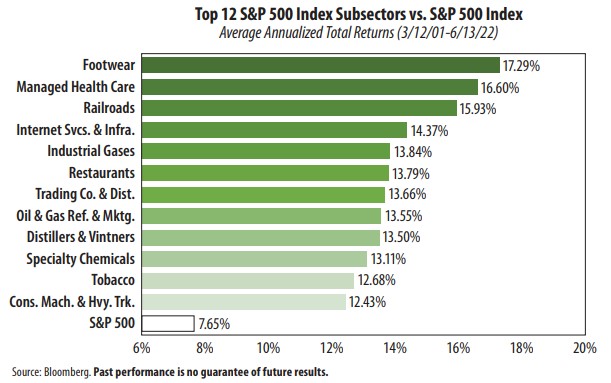

5. We selected the period in the chart above (over 20 years) to show how the S&P 500 Index and its top-performing subsectors have performed since the

bursting of the technology bubble at the start of this millennium. The start date of 3/12/01 was selected because it marked the point in which the S&P 500

Index moved into bear market territory. For the record, the peak in the S&P 500 Index (closed at 1,527.46) happened on 3/24/00.

6. The S&P 500 Index is comprised of 11 sectors and 122 subsectors, according to S&P Dow Jones Indices. We are focusing on the subsectors to show which industries performed the best over the period.

7. For comparative purposes, from 1926-2021 (96 years), the S&P 500 Index posted an average annual total return of 10.46%, according to Morningstar/

Ibbotson Associates.

8. Our takeaways from this snapshot are that investors can prosper with a buy and hold strategy and they do not have to necessarily overweight the newest,

shiniest, most cutting-edge industries to make a buck.