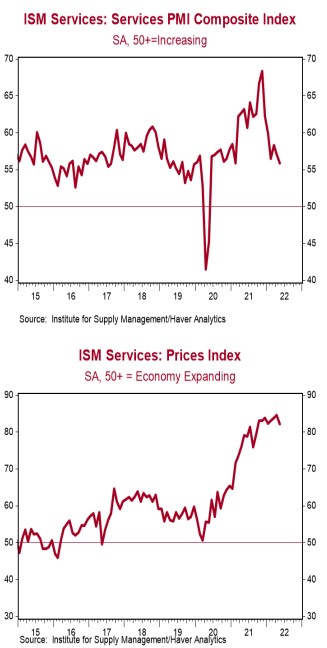

- The ISM Non-Manufacturing index slowed to 55.9 in May, missing the consensus expected 56.5. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mixed in May, but all stand above 50, signaling growth. The new orders index rose to 57.6 from 54.6, while the business activity index dropped to 54.5 from 59.1. The employment index increased to 50.2 from 49.5, while the supplier deliveries index declined to 61.3 from 65.1.

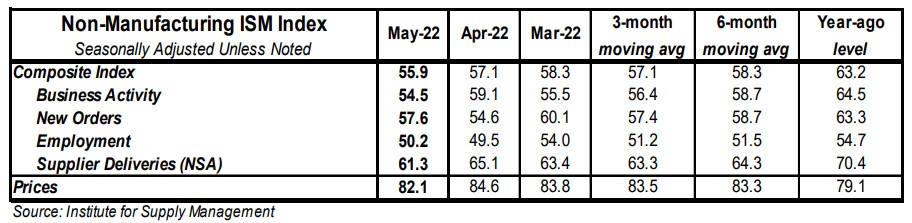

- The prices paid index declined to 82.1 in May from 84.6 in April.

Implications:

The service sector continued to expand in May although at a slower pace than in April, with the headline service-sector index declining to 55.9 from 57.1. Were it not for supply-chain disruptions lingering from COVID as well as inflationary headwinds, the service sector would be doing even better. One comment in May's report summed it up by describing the current environment as, "Exhausting. Continuous shortages, transportation delays and price increases all contribute to the destruction of historical lead times and firm commitments on delivery dates... It is relentless." This is what happens when you add money to the system at a faster pace than you can grow output. Until the Federal Reserve gets money growth under control, these problems are here to stay. That said, the service sector still expanded at a healthy clip in May, with fourteen of eighteen industries reporting growth, and should benefit this year as consumers shift their spending preferences away from expensive goods and towards the still-recovering service sector. Looking at the details of the report, business activity, and new orders – the two most forward-looking indices – were mixed in May, but both stand comfortably above 50, signaling growth. Meanwhile, there was an improvement in the labor market, as the employment index moved back into expansion territory. This helped pushed the index for supplier deliveries (a measurement of lead times for businesses) down to 61.3, which remains well off its recent peak of 75.7 set back in late 2021. Finally, the highest reading for any category continues to come from the prices index, even though it fell a couple of points from its all-time high set last month. This decline should fool no one – prices are continuing to rise in the service sector and at a historically fast pace. All 18 industries reported paying higher prices in May, while forty-five commodities were listed up in price, and only two (copper and steel products) were reported down. In other recent news, data out earlier this week showed that car and light truck sales fell 12.5% in May to a 12.7 million annual rate. The key impediment to auto sales remains supply constraints, largely related to a lack of computer chips. Look for that problem to ease in the second half of 2022, resulting in a faster pace of sales.