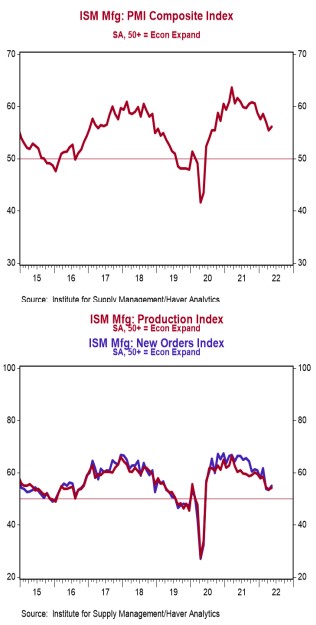

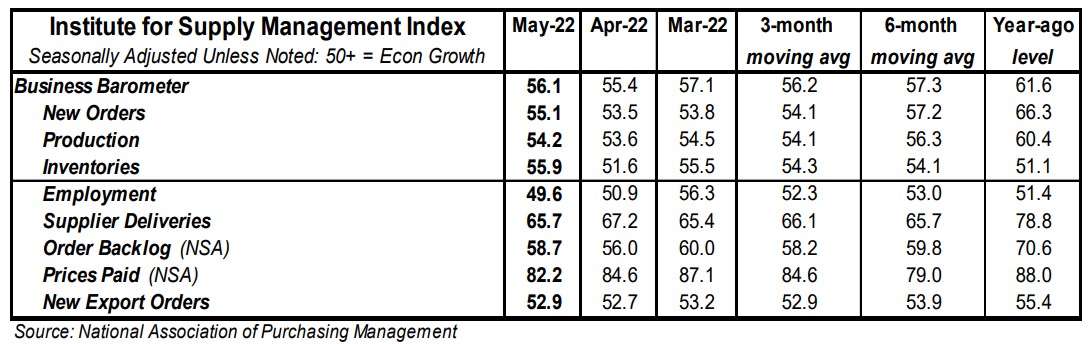

- The ISM Manufacturing Index increased to 56.1 in May, beating the consensus expected 54.5. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mixed in May, but nearly all stand above 50, signaling growth. The production index rose to 54.2 from 53.6 in May, while the new orders index increased to 55.1 from 53.5. The employment index fell to 49.6 from 50.9, and the supplier deliveries index fell to 65.7 from 67.2 in May.

- The prices paid index declined to 82.2 in May from 84.6 in May.

Implications:

The manufacturing sector continued to expand in May, and at a slightly faster pace, with fifteen of eighteen industries reporting growth. The best news in today's report was that the two most forward-looking indices, new orders and production, posted gains after two months in a row of declines. Moreover, both indices are above 50, signaling growth. Respondent comments in May highlighted strong ongoing demand from customers while also reiterating supply-chain problems related to shortages of key inputs and transportation services. The ongoing COVID-19 shutdowns in China were explicitly mentioned in the comments as well, with gridlock at the ports exacerbating the ongoing issues already mentioned. These issues have all come together to keep manufacturing activity from rising quickly enough to meet an explosion of demand. The good news is that progress is being made, with the supplier deliveries index falling in May and sitting well below its recent high one year ago. However, delays are far from over, with fifteen of eighteen industries reporting waiting longer for inputs. This, in turn, has resulted in long lead times for the clients of US factories, who continued to see their inventories shrink in May. Meanwhile, the employment index fell (barely) into contraction territory in May, declining to 49.6 from 50.9 in April. It looks like the manufacturing sector, which is one of the worst-hit sectors in the ongoing labor shortage, is contending with a tight labor market just like everyone else. Data out this morning shows that job openings in the manufacturing sector are at a record high and roughly 150% of where they were pre-pandemic. Finally, the highest reading of any index in May continued to come from the prices index, which fell slightly to 82.2 but remains very elevated versus history. It looks like the invasion of Ukraine, and now the shutdowns in China, have temporarily boosted inflationary pressure over and above pre-existing inflation related to an overly expansionary Federal Reserve. Inflation this year will ultimately moderate from the pace we saw last year, but not just yet. In other news this morning, construction spending increased 0.2% in April, with large increases in home building and manufacturing offsetting declines in power and transportation projects. In other recent news, home prices continued to surge in March. The national Case-Shiller index increased 2.6% in March and is up 20.6% from a year ago, both record increases. The price gains in the past twelve months were led by Tampa, Phoenix, and Miami, with the slowest price gains in Minneapolis, Washington, DC, and Chicago. The FHFA index, which measures prices for homes financed with conforming mortgages, increased 1.5% in March and is up 19.0% from a year ago. Look for further national price gains in the remaining months of 2022, but at a much slower average pace. Prior price gains plus higher mortgage rates will be significant headwinds for further price gains in the next few years.