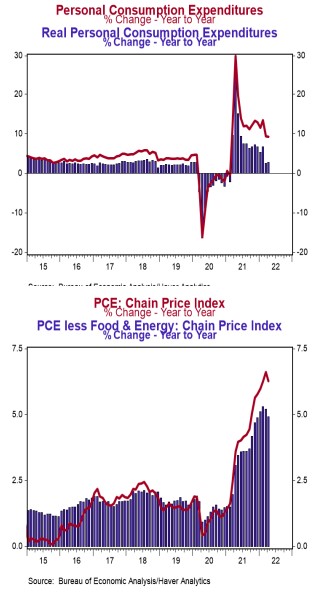

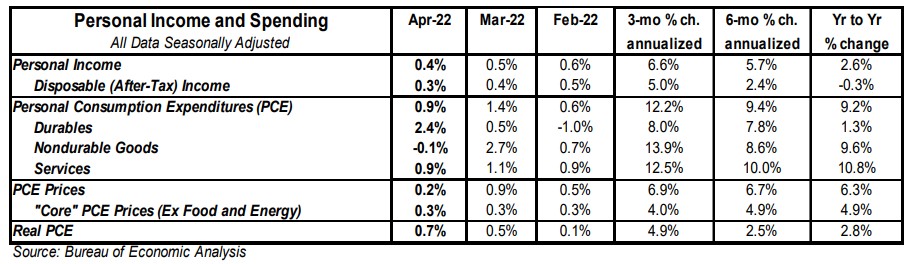

- Personal income rose 0.4% in April (+0.6% including revisions to prior months), versus a consensus expected +0.5%. Personal consumption rose 0.9% in April (+1.2% including prior months' revisions), beating the consensus expected +0.8%. Personal income is up 2.6% in the past year, while spending has increased 9.2%.

- Disposable personal income (income after taxes) increased 0.3% in April, but is down 0.3% from a year ago.

- The overall PCE deflator (consumer prices) rose 0.2% in April and is up 6.3% versus a year ago. The "core" PCE deflator, which excludes food and energy, rose 0.3% in April and is up 4.9% in the past year.

- After adjusting for inflation, "real" consumption rose 0.7% in April and is up 2.8% from a year ago.

Implications:

An all-around healthy report on the consumer today, as incomes and spending rose, price pressures moderated (though not by much), and upward revisions to prior months show no sign of an economy on the verge of recession. While incomes rose 0.4% in April, the more important news is that the increase was led by a 0.6% rise in private-sector wages and salaries. Compared to a year ago, personal income is up 2.6%, lagging the 6.3% rise in inflation of the same period. However, the headline income number hides an important transition taking place. Strip out government transfer payments – the economic morphine that Washington relied on to cover up the pain of bad COVID policies – and personal income is up 8.4% in the past year, with private-sector wages and salaries up a massive 12.7% over the same period. Consumption, meanwhile, rose 0.9% in April and is up 9.2% from a year ago. Diving into the details shows a clear transition from goods towards services. While spending on both goods and services rose in April, services are up 10.8% from a year ago while spending on goods is up 6.4%. As COVID restrictions have faded, people have gotten back outside to the leisure and travel activities that were hampered for much of the past two years. Since bottoming in April of 2020, consumption has grown at an astronomical 19.1% annual rate and today stands 15.4% above February 2020 levels. But artificially booming demand, the result of government transfers and rapid growth in the M2 money supply, is not a free lunch. PCE prices, the Fed's preferred measure of inflation, rose 0.2% in April following March's 0.9% surge (the largest monthly increase in more than 15 years), and are up 6.3% from a year ago. Core prices, which exclude food and energy, rose 0.3% in April and are up 4.9% from a year ago, neither anywhere close to the Federal Reserve's 2.0% target. In other recent news, pending home sales, which are contracts on existing homes, declined 3.9% in April after falling 1.6% in February, suggesting another drop in existing home sales (counted at closing) in May. On the manufacturing front, the Kansas City Fed Index declined to a still strong +23 in May from +25 in April. Plugging this into our models suggests a solid reading of 55.4 from next week's national ISM manufacturing report.