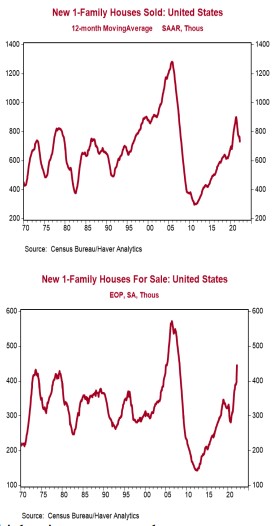

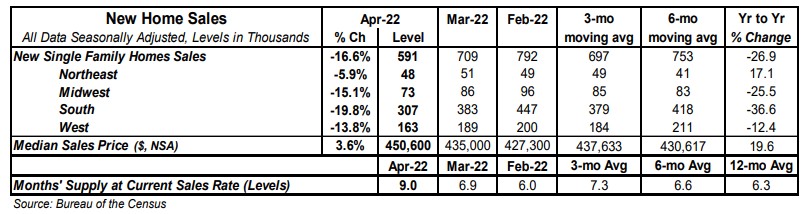

- New single-family home sales dropped 16.6% in April to a 0.591 million annual rate, well below the consensus expected 0.749 million. Sales are down 26.9% from a year ago.

- Sales in April fell in all of the major regions.

- The months' supply of new homes (how long it would take to sell all the homes in inventory) rose to 9.0 in April from 6.9 in March. The gain was due to both a slower pace of sales and a 34,000 unit increase in inventories.

- The median price of new homes sold was $450,600 in April, up 19.6% from a year ago. The average price of new homes sold was $570,300, up 31.2% versus last year.

Implications:

No doubt about it, today's report on the housing market was ugly. New home sales fell for the fourth month in a row in April, coming in below even the most pessimistic forecast by any economics group. At a 591,000 annual rate, the sales pace in April was just 1.5% above the bottom set during the initial days of the COVID-19 pandemic exactly two years ago. The housing market is clearly struggling to find some footing so far in 2022 due to declining affordability. While rapidly rising prices have been an issue in the housing market throughout the COVID-19 pandemic, the recent run-up in borrowing costs has been adding to the burden as the Federal Reserve begins to tighten monetary policy. Assuming a 20% down payment, the rise in mortgage rates and home prices just since December amount to a 42% increase in monthly payments on a new 30-year mortgage for the median new home. No wonder new home sales posted the largest monthly decline in nine years in April. Also keep in mind that new home sales are a very timely barometer of the housing market because they are counted when the contract is signed rather than when the contract is closed, like with existing homes. That said, if the Federal Reserve is hoping to get housing inflation under control through higher interest rates, the progress has been slow. While median sales price growth has decelerated from a year-over-year a peak of 24.2% in August, prices were still up 19.6% in the twelve months ending in April. The main problem is still that buyers are stuck dealing with very few options when it comes to completed homes. It's true that overall inventories have been rising recently and now sit at the highest level since 2008. This has pushed up the months' supply (how long it would take to sell the current inventory at today's sales pace) to 9.0 from a record low reading of 3.3 in mid-2020. However, almost all of this inventory gain is from homes where construction has either not yet started or is still underway. Doing a similar calculation with only completed homes on the market shows a months' supply of a meager 0.8, near the lowest level on record back to 1999. The good news is that builders have been ramping up construction activity to help meet demand, with the total number of single-family homes under construction currently at the highest levels since 2006. Ultimately, that added supply will facilitate more sales while slowing the pace of new home price appreciation. Despite today's weak data, we don't expect sales to stay at April's level. Ultimately, we think the market will be able to weather the headwinds of higher mortgage rates in 2022, with sales of new homes only slightly down versus 2021. In other news this morning, the Richmond Fed Manufacturing Index, which measures mid-Atlantic manufacturing sentiment, fell to -9 in May from 14 in April. This is consistent with our projection of a plodding 2.0% annualized real GDP growth rate in the second quarter.