View from the Observation Deck

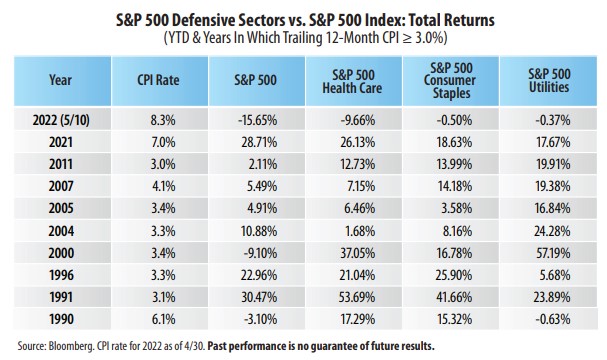

1. Year-to-date through 5/10/22, the S&P 500 Index was down 15.65% on a total return basis. The question is: Could robust inflation pose even more of a threat

to the broader stock market (S&P 500 Index) if sustained?

2. We looked back to 1990 and selected those calendar years where inflation, as measured by the Consumer Price Index (CPI), rose by 3.0% or more on a trailing

12-month basis.

3. Why 3.0%? From 1926-2021, the average CPI rate was 3.0%, according to data from the Bureau of Labor Statistics.

4. For comparative purposes, we selected three defensive sectors (Health Care, Consumer Staples and Utilities) to see how their returns matched up with those of the S&P 500 Index.

5. The premise being that defensive sectors tend to be less cyclical in nature than their counterparts and can potentially offer investors better performance

results in volatile markets.

6. As indicated in the chart, the defensive sectors posted a good showing relative to the S&P 500 Index overall, and all three outperformed the broader market in

1990, 2000, 2007 and 2011.

7. While all three of the defensive sectors are outperforming the S&P 500 Index so far this year, Health Care has significantly lagged both Consumer Staples and

Utilities (see table). One of the key reasons for this could be tied to the Biden administration’s talk of targeting rising drug prices, in our opinion. The

discussion of regulatory intervention, such as potential price controls, has been a popular wedge issue in previous election years.