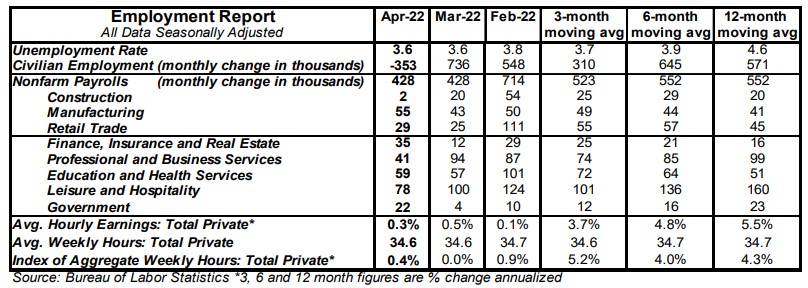

- Nonfarm payrolls increased 428,000 in April versus a consensus expected 380,000. Payroll gains for February and March were revised down by a total of 39,000, bringing the net gain, including revisions, to 389,000.

- Private sector payrolls rose 406,000 in April but were revised down 37,000 in prior months. The largest increases in April were for leisure & hospitality (+78,000), education & health services (+59,000), manufacturing (+55,000), and transportation & warehousing (+52,000). Government increased 22,000.

- The unemployment rate remained at 3.6% in April.

- Average hourly earnings – cash earnings, excluding irregular bonuses/commissions and fringe benefits – rose 0.3% in April and are up 5.5% versus a year ago. Aggregate hours increased 0.4% in April and are up 4.3% from a year ago.

Implications:

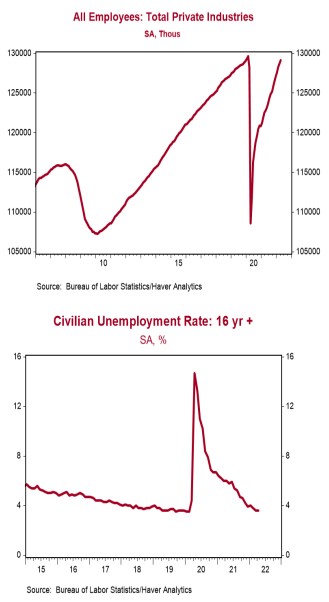

Let this be your monthly reminder that although the Federal Reserve is getting less loose, it's not yet tight and the US job market continues to improve. Nonfarm payrolls rose 428,000 in April, beating consensus expectations. And although payrolls are still about 1.2 million below where they were before COVID, the total number of hours worked rose 0.4% in April to reach a new record high, finally beating the pre-COVID peak. However, not all the news on the labor market was as good. Civilian employment, an alternative measure of jobs that includes small-business start-ups, declined 353,000 in April. That helped keep the unemployment rate at 3.6%. The labor force – people who are either working or looking for work – dropped 363,000. As a result, the participation rate declined to 62.2% in April from 62.4% in March, while the share of adults who are working ticked down to 60.0% from 60.1%. Although average hourly wages grew what would normally be a respectable 0.3% for the month, that's not so respectable in an era with high inflation. Average hourly earnings are up 5.5% from a year ago while consumer prices are up near 8.5%. That means an overly loose monetary policy has generated so much inflation that the average worker is falling behind in hourly pay even as his nominal wages go up. Where does all this data leave the Fed? In the same bind it was yesterday. Inflation is running too hot and it needs to move as rapidly as possible to a restrictive monetary policy to bring it down. Ultimately that entails increasing the risk of a recession, but that recession is very unlikely to materialize this year. Investors should expect continued job growth in the months ahead, although at a slower pace than the 518,000 average monthly pace so far this year.