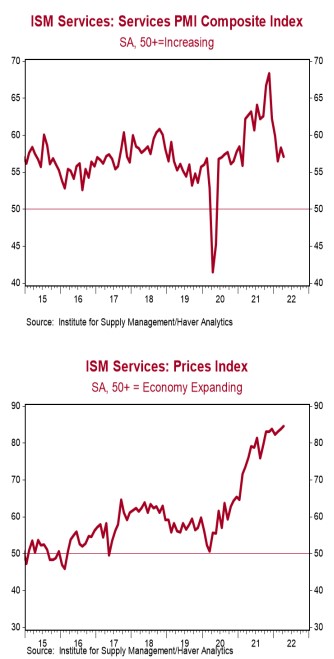

- The ISM Non-Manufacturing index slowed to 57.1 in April, missing the consensus expected 58.5. (Levels above 50 signal expansion; levels below signal contraction.)

- The major measures of activity were mixed in April, but most stand above 50, signaling growth. The business activity index rose to 59.1 from 55.5, while the new orders index dropped to 54.6 from 60.1. The employment index declined to 49.5 from 54.0, while the supplier deliveries index increased to 65.1 from 63.4.

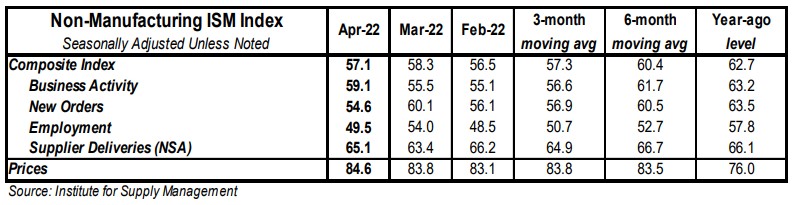

- The prices paid index rose to 84.6 in April from 83.8 in March.

Implications:

The service sector continued to expand rapidly in April, albeit at a slightly slower pace than March, as inflation, supply-chain issues, and labor shortages continue to prevent activity from expanding even more quickly. Overall gains were broad-based, with seventeen of eighteen industries reporting growth. Business activity and new orders – the two most forward-looking indices – were mixed in April, but both stand comfortably above 50, signaling growth. Survey comments highlighted inflation, supply-chain issues, and difficulty finding qualified workers as problems their businesses face when trying to meet the explosion of demand since our economy began re-opening. These concerns were reflected in several of the major category indices. First, the prices paid index rose to 84.6 in April, an all-time high for the category dating back to 1997. In total, 39 commodities were reported up in price for the month of April while only one (fuel) reported down. Second, the supplier deliveries index moved higher in April and remains at a historically elevated 65.1, signaling longer lead times for businesses. Third, the employment index fell back into contraction territory, as the service sector struggles to find qualified workers. Labor shortages have been widespread throughout the US economy, as the Job Openings and Labor Turnover Survey (JOLTS) recently reported 11.5 million US job openings in the month of March, a new record high. Despite these persistent headwinds, the service sector remains well in expansion territory, and there are reasons for optimism. Though still historically elevated, the index for order backlogs declined in April and remains below the high set in late 2021. Meanwhile, the inventories index expanded for the third straight month, suggesting businesses are starting to finally re-stock their shelves. Keep in mind that pre-pandemic, services made up roughly 69% of consumption spending. That number fell to 64% during the depths of the pandemic as people stopped going to concerts, movies, restaurants, etc. Expect to see continued growth in the service sector in the months ahead as spending continues to shift back to the pre-pandemic status quo.