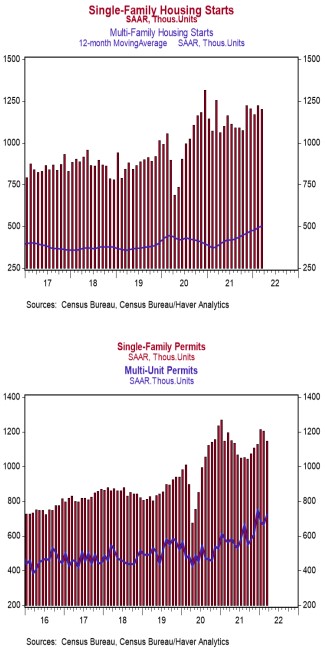

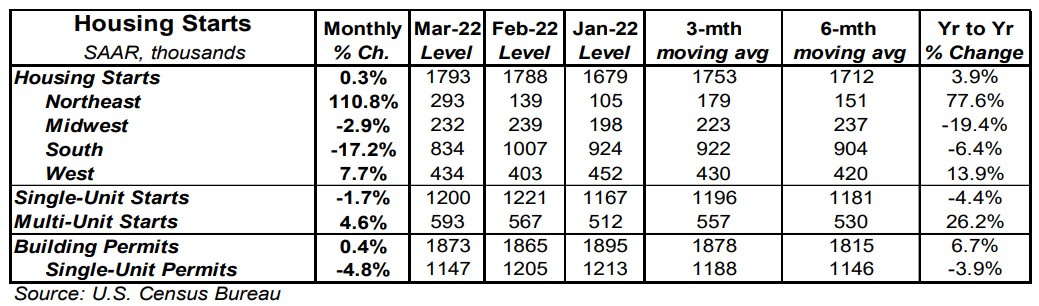

- Housing starts increased 0.3% in March to a 1.793 million annual rate, easily beating the consensus expected 1.740 million. Starts are up 3.9% versus a year ago.

- The gain in March was due entirely to multi-family starts. Single-family starts declined in March. In the past year, single-family starts are down 4.4% while multi-unit starts are up 26.2%.

- Starts in March rose in the Northeast and West but fell in the South and Midwest.

- New building permits rose 0.4% in March to a 1.873 million annual rate, easily beating the consensus expected 1.820 million. Compared to a year ago, permits for single-family units are down 3.9% while permits for multi-family homes are up 29.4%.

Implications:

Housing starts surprised to the upside in March, posting the fifth gain in the past six months to hit the fastest pace since 2006. Multi-family construction was entirely responsible for the headline gain of 0.3%, which came atop upward revisions for February. Notably, multi-family construction is up 26.2% in the past year while new single-family construction has declined 4.4%. As we mentioned in a recent Monday Morning Outlook, rents have been rising rapidly due to a host of factors that are likely to continue for the foreseeable future, causing developers to shift resources toward apartment buildings. Zillow estimates that rental costs for new tenants are up 16.8% in the year ending March 2022 while Apartmentlist.com estimates they have risen 17.1% over the same period, easily exceeding typical gains in the 3.0 - 4.0% range. Meanwhile, 30-year mortgage rates are now above 5%, which has pushed some potential buyers back into the rental market. Recent distributional effects aside, the ongoing increases in housing starts are doubly impressive given that the number of homes already under construction are at the highest level since 1973. Moreover, builders still have a huge number of permitted projects sitting in the pipeline waiting to be started. In fact, the backlog of projects that have been authorized but not yet started is currently the highest since the series began back in 1999. These figures are a testament to not only high housing demand but also a slower construction process due to a lack of workers and other supply-chain difficulties. Despite this, permits for new construction managed to eke out a 0.4% gain in March, as well. With plenty of future building activity in the pipeline, builders looking to boost the near record-low levels of inventory to satisfy buyers, and as more Millennials finally enter the housing market, it looks very likely new construction in 2022 will surpass the 1.605-million units built last year. Keep in mind the US needs roughly 1.5 million housing starts per year based on population growth and scrappage (voluntary knockdowns, natural disasters, etc.), and 2021 was the first year in the aftermath of the 2008/9 recession that has crossed that threshold. In other recent housing news, the NAHB Housing Index, which measures homebuilder sentiment, declined slightly to 77 in April from 79 in March. While this is the lowest reading in seven months, it's important to remember that these readings remain near historical highs, still signaling robust optimism from developers.