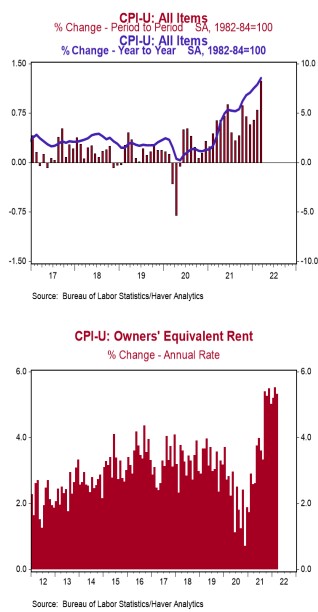

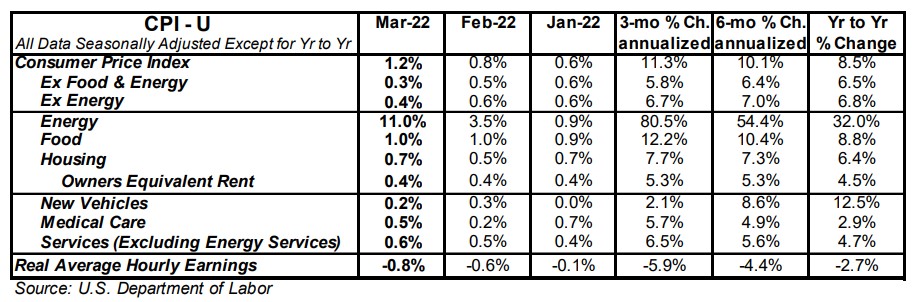

- The Consumer Price Index (CPI) increased 1.2% in March, matching consensus expectations. The CPI is up 8.5% from a year ago.

- Energy prices increased 11.0% in March, while food prices increased 1.0%. The "core" CPI, which excludes food and energy, rose 0.3% in March, below the consensus expected +0.5%. Core prices are up 6.5% versus a year ago.

- Real average hourly earnings – the cash earnings of all workers, adjusted for inflation – declined 0.8% in March and are down 2.7% in the past year. Real average weekly earnings are down 3.6% in the past year.

Implications:

Consumer prices soared in March, posting the largest monthly increase in more than fifteen years. As expected, the 1.2% increase was mostly driven by a spike in energy prices related to the Russia-Ukraine War. Energy prices increased 11.0% in March (driven by an 18% rise in gasoline prices). But this is not all war-related. Ultimately, inflation is due to an overly loose monetary policy from the Federal Reserve; the war just influences the timing of the inflation as well as the sectors in which the inflation appears. Prices rose for food in March, as well, increasing 1.0% for the second consecutive month and up at a blistering 12.2% annualized pace in the last three months. Stripping out the volatile food and energy sectors, "core" prices rose 0.3% for the month, and are up 6.5% in the past year, the highest in nearly 40 years. Housing rents (for both actual tenants and the rental value of owner-occupied homes) continue to drive core inflation, rising 0.4% for the month. We expect rents to be a key driver for inflation in 2022 and beyond because they make up more than 30% of the overall CPI, and still have a long way to go to catch up to home prices, which have skyrocketed more than 30% since COVID started. Other movers in today's report were prices for airline fares (+10.7%) and hotels/motels (+3.7%), signaling increased demand from COVID re-opening and constrained labor markets. Prices for used cars fell 3.8% in March, taking away two-tenths of a percentage point from the increase in core prices. Used and new car prices will be important categories to watch in the coming months as both are up massively since COVID started, but could ease with improvements in supply-chains. Overall consumer prices are up 8.5% in the last year, which is the highest in four decades. The good news is that year-ago inflation comparisons are now at or very close to the peak. The bad news is that even if it declines from recent levels, inflation is very likely to remain well above the Fed's supposed 2.0% target for at least the next few years. The US is now stuck in a Keynesian dilemma of its own making. The M2 measure of the money supply is up over 40% since COVID started and the Fed is nowhere close to being tight. And tight it will have to get in order to tame the inflation it's unleashed.