View from the Observation Deck

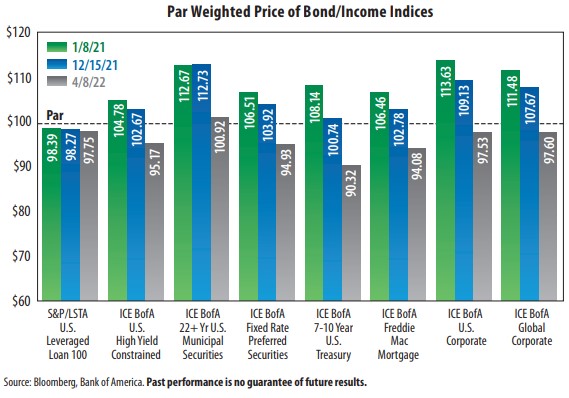

1. Today's blog post is one we do ongoing so that investors can monitor fluctuations in bond prices relative to changes in interest rates. The dates in the chart are from prior posts.

2. The Federal Reserve ("Fed") hiked the federal funds target rate (upper bound) by 25 basis points (bps) to 0.50% on 3/16/22. The last Fed rate hike occurred on 12/19/18, when it raised by 25 bps to 2.50% (most recent high), according to data from the Fed.

3. For the 30-year period ended 4/8/22, the federal funds target rate (upper bound) averaged 2.48% (essentially matching where it stood on 12/19/18), according to Bloomberg. It reached as high as 6.50% in May 2000.

4. The yield on the benchmark 10-year Treasury note (T-note) rose from 1.12% at the close on 1/8/21 to 2.71% at the close on 4/8/22, or an increase of 159 bps, according to Bloomberg. Its average yield was 3.98% for the 30-year period ended 4/8/22.

5. For comparative purposes, here were the closing yields as of 4/8/22 for the indices featured in the chart: 4.44% (U.S. Leveraged Loan 100); 6.57% (U.S. High Yield Constrained); 4.01% (22+ Yr. Municipal Securities); 5.32% (Fixed Rate Preferred Securities); 2.73% (7-10 Yr. U.S. Treasury); 3.38%% (Freddie Mac Mortgage); 3.93% (U.S. Corporate ); and 3.33% (Global Corporate), according to Bloomberg.

6. As indicated in the chart, the price declines in the 7-10 Year U.S. Treasury Index and the U.S. Corporate Index were clearly the most dramatic between 1/8/21 and 4/8/22.

7. The trailing 12-month Consumer Price Index (CPI) rate stood at 8.5% in March 2022, according to the Bureau of Labor Statistics. That is up significantly from its 2.6% level in March 2021 and its 2.4% average rate over the past 30 years.

8. In addition to the multiple rate hikes and quantitative tightening measures expected from the Fed this year, bond investors should also monitor the ongoing COVID-19 pandemic, which is hitting China hard right now, and the war between Russia and Ukraine, to see what impact these events may have on energy prices and the global economy. Stay tuned!