View from the Observation Deck

1. One of the most common questions we field on an ongoing basis is the following: What are your favorite sectors?

2. Sometimes the answer is more evident than at other times, such as Energy in the current climate, and sometimes it only makes sense via hindsight, in our opinion.

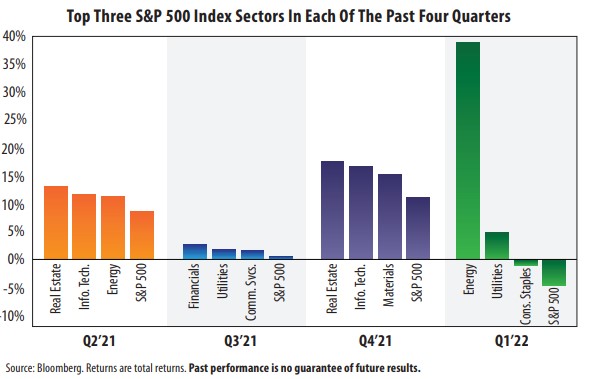

3. The top-performing sectors in Q1'22 were as follows (total returns): 38.99% (Energy), 4.77% (Utilities) and -1.01% (Consumer Staples). The total return on the S&P 500 Index was -4.60%. The other eight sectors generated total returns ranging from -11.92% (Communication Services) to -1.48% (Financials).

4. Here is how many times each of the major sectors have made it into the top 3 on a quarterly basis since the start of the COVID-19 pandemic (12/31/19- 3/31/22): 5 (Energy); 4 (Information Technology); 3 (Financials); 3 (Industrials); 2 (Consumer Discretionary); 2 (Consumer Staples); 2 (Materials); 2 (Real Estate); 2 (Utilities); 1 (Communication Services); and 1 (Health Care), according to Bloomberg.

5. For comparative purposes, the following shows the cumulative total returns for these sectors over that same period: 77.38% (Information Technology); 50.89% (Consumer Discretionary); 50.01% (Materials); 42.28% (Energy); 39.40% (Health Care); 33.93% (Real Estate); 32.36% (Communication Services); 31.30% (Industrials); 30.53% (Financials); 30.05% (Consumer Staples); and 23.93% (Utilities), according to Bloomberg. The S&P 500 Index posted a cumulative total return of 45.33% during the period.

6. Click here to access the post featuring the top-performing sectors in Q2'20, Q3'20, Q4'20 and Q1'21.