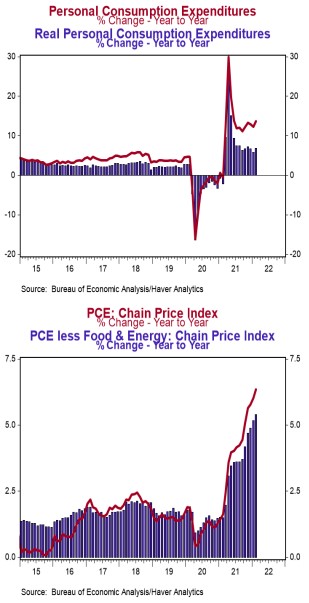

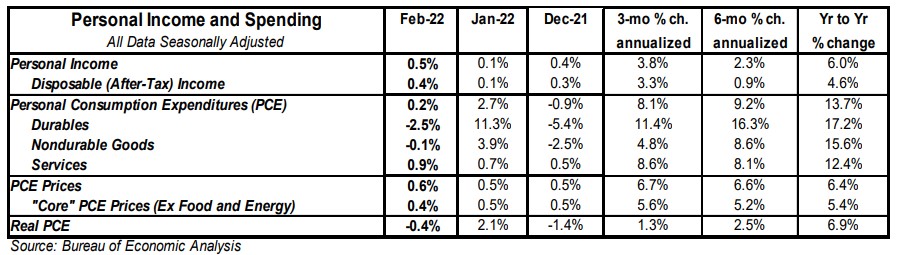

- Personal income rose 0.5% in February, matching consensus expectations. Personal consumption rose 0.2% in February (+0.6% including prior months' revisions) versus a consensus expected +0.5%. Personal income is up 6.0% in the past year, while spending has increased 13.7%.

- Disposable personal income (income after taxes) increased 0.4% in February and is up 4.6% from a year ago.

- The overall PCE deflator (consumer prices) rose 0.6% in February and is up 6.4% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.4% in February and is up 5.4% in the past year.

- After adjusting for inflation, “real” consumption declined 0.4% in February but is up 6.9% from a year ago.

Implications:

Both incomes and spending rose in February, with the economy returning to the fundamental drivers of activity and away from the effects of temporary and artificial stimulus boosters implemented in 2020-21. Private-sector wages and salaries led the growth in income, up 0.9% in February, more than offsetting a 0.3% decline in government transfer payments. Compared to a year ago, personal income is up 6.0% while personal consumption is up 13.7%. Look for the year-ago comparisons to be muddied again next month as the last (and largest) stimulus checks were sent out in March 2021, which led to a temporary jump in both incomes and consumption. On the spending side, personal consumption rose 0.2% in February (+0.6% including prior months’ revisions), with consumers shifting their purchases toward services and away from goods as falling COVID cases and related mandates encouraged many to get outside in February. Since bottoming in April of 2020, consumption has grown at an astronomical 19.7% annualized rate, and spending today stands 13.0% above February 2020 levels. But artificially booming demand, the result of government transfers and rapid growth in the M2 money supply, is not a free lunch. PCE prices, the Fed’s preferred measure of inflation, rose 0.6% in February, and are up 6.4% from a year ago. Core prices, which exclude food and energy, rose 0.4% in February and are up 5.4% from a year ago. By either measure, inflation is too high. And the geopolitical conflict in Ukraine isn’t going to help ease inflation pressure in the short term. The Fed signaled at their last meeting they’re taking a more aggressive stance in raising rates, but they remain well behind the curve in fighting inflation. Monetary policy is becoming less loose, but nowhere near tight. In other news this morning, the Chicago PMI, a measure of business activity in the region, rose to 62.9 in March from 56.3 in the February, boding well for tomorrow’s national ISM report. On the jobs front, initial unemployment claims increased 14,000 last week to 202,000 while continuing claims declined 35,000 to 1.307 million, the lowest level since 1969. After plugging these into our model, we expect Friday's employment report to show a robust nonfarm payroll gain of 495,000.