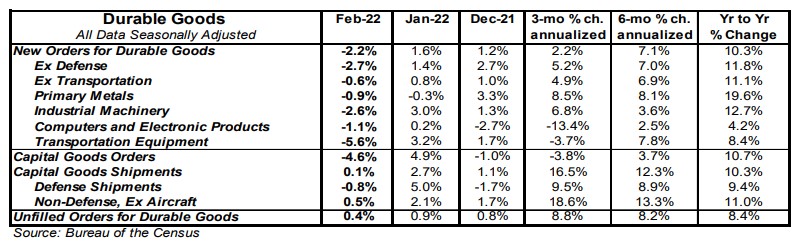

- New orders for durable goods declined 2.2% in February, coming in below the consensus expected -0.6%. Orders excluding transportation declined 0.6% in February (-0.5% including revisions to prior months), versus a consensus expected gain of 0.6%. Orders are up 10.3% from a year ago, while orders excluding transportation are up 11.1%.

- The decline in orders in February was led by non-defense aircraft, machinery, and autos.

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure increased 0.5% in February. If unchanged in March, these shipments will be up at a 15.9% annualized rate in Q1 versus the Q4 average.

- Unfilled orders rose 0.4% in February and are up 8.4% in the past year.

Implications:

New orders for durable goods disappointed in February, as a large drop in commercial aircraft orders led a broad-based decline across categories. While the pullback in orders exceeded consensus expectations, it’s worth noting that this is only the second decline in orders in the past ten months. And activity remains robust when viewed over the last six (+7.1% annualized) and twelve (+10.3%) month periods. Looking at the details of today’s report, the key driver of the decline was the typically volatile commercial aircraft segment, which fell 30.4% in February after jumping 95.0% over the prior three months. In other words, take that February pullback with a grain of salt. That said, orders still slipped 0.6% when stripping out transportation, with nearly every major category posting declines. Electrical equipment (+0.2% in February) was the sole major category where orders rose, but couldn’t come close to offsetting the combined pullbacks in orders for machinery (-2.6%), computers and electronic products (-1.1%), primary metals (-0.9%), and fabricated metal products (-0.1%). One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), rose 0.5% in February, following a strong print in January as well. If these shipments are unchanged in March, that would represent a 15.9% annualized gain in Q1 versus the Q4 average. Look for business investment to continue to be a tailwind for GDP growth in 2022. With a combined 67.8% increase since the April 2020 bottom, new orders now sit 17.6% above the prepandemic high set two years ago, an extremely sharp recovery. In employment news this morning, initial unemployment claims declined 28,000 last week to 187,000, the lowest weekly reading since September of 1969. Meanwhile, continuing claims fell 67,000 to 1.350 million, the lowest reading since early 1970. Look for another strong employment report for March when that’s released next Friday.