View from the Observation Deck

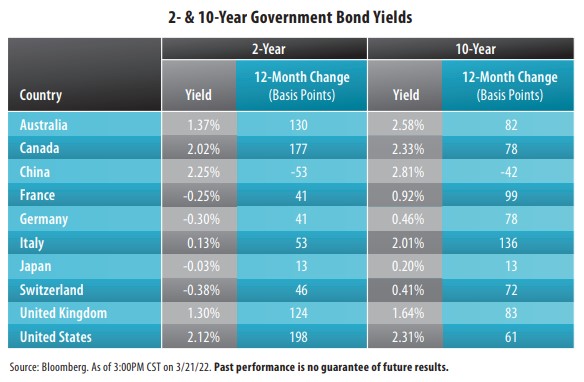

1. Today's blog post shows the yields on a couple of benchmark government bond maturities from key countries/economies around the globe.

2. While bond yields are up from their historic lows, in most instances, they remain depressed.

3. The yield on the U.S. 10-year Treasury Note (T-note) stood at 2.31% as of 3:00PM CST on 3/21/22, 180 basis points (bps) higher than its all-time closing low of 0.51% on 8/4/20 (not in table), but 168 basis points below its 3.99% average yield for the 30-year period ended 3/21/22 (not in table), according to Bloomberg.

4. The yield spread between the U.S. 2-year T-note and the 10-year T-note was approximately 19 basis points as of 3:00PM CST on 3/21/22, well below its 30- year average spread of 115 basis points as of 3/21/22, according to Bloomberg.

5. On 3/16/22, the Federal Reserve ("Fed") initiated a 25 basis point hike in the federal funds rate. The median Fed official is signaling another six hikes, totaling 150 basis points, through year-end, according to Brian Wesbury, Chief Economist at First Trust Advisors L.P. That would equate to 175 basis points in aggregate. The Fed also signaled it could raise rates an additional 75-100 basis points in 2023.

6. To illustrate just how fast things can change, Fed Chairman Jerome Powell announced yesterday (3/21/22) that the Fed is willing to raise interest rates “faster than expected,” and high enough to curb growth and hiring, if it deems it necessary to slow surging inflation, according to U.S. News & World Report.

7. With the rise in government bond yields throughout much of the globe over the past year, the amount of negative-yielding debt has declined significantly, as measured by the Bloomberg Global Aggregate Negative Yielding Debt Index. The total value stood at $3.41 trillion on 3/21/22, down from $13.81 trillion a year ago.

8. We will continue to monitor the situation to see if rising inflation plus any tapering the Fed does to its balance sheet of assets is enough to push bond yields higher in the months ahead.