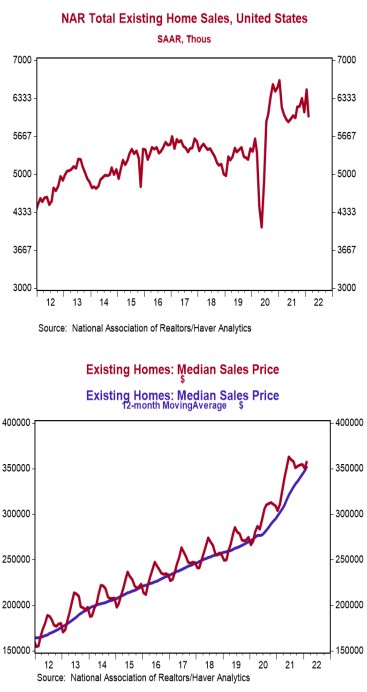

- Existing home sales declined 7.2% in February to a 6.020 million annual rate, below the consensus expected 6.100 million. Sales are down 2.4% versus a year ago.

- Sales in February fell in all major regions. The drop was due to both single-family homes and condos/co-ops.

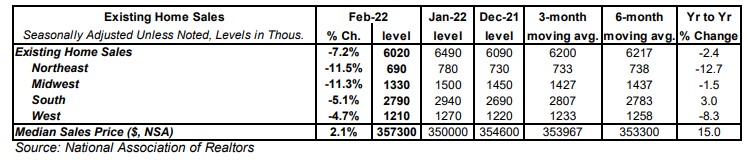

- The median price of an existing home rose to $357,300 in February (not seasonally adjusted) and is up 15.0% versus a year ago. Average prices are up 8.4% versus last year.

Implications:

Existing home sales fell sharply in February after a surge in January. Recent volatility shows that the housing market is struggling to find its footing so far in 2022, with falling affordability likely playing a role. The prime culprit recently has been 30-year mortgage rates, which have already risen roughly 130 basis points since December. When adding in recent price increases as well, the National Association of Realtors claims monthly payments on new mortgages are up 28% on average in the past year. Potential buyers are also dealing with a lack of available supply in the market. While the number of listed, but unsold, existing homes rose 20,000 to 870,000 in February, it’s important to remember that January’s reading was an all-time low going back to 1999. Our expectation is that listings will start to move upward in 2022 again, at least on a seasonally adjusted basis, as virus fears fade in the Spring and sellers feel more comfortable showing their homes. Meanwhile, the months’ supply of existing homes for sale (how long it would take to sell today’s inventory at the current sales pace) rose slightly to 1.7 months in February, also coming off a record low reading of 1.6 in January. Despite affordability issues there is still significant pent-up demand, with buyer urgency so strong in February that 84% of existing homes sold were on the market for less than a month. The combination of strong demand and sparse supply has pushed median prices up 15.0% in the past year, but the good news is that price gains have decelerated since hitting a year-to-year gain of 23.6% in May. Put it all together and we do not foresee any sort of collapse in home sales even with higher mortgage rates. More inventory will eventually become available and price gains will moderate. Also keep in mind that Millennials are now the largest living generation in the US and have begun to enter the housing market in force, making up over 50% of new mortgage issuance for the first time in 2019. This represents a demographic tailwind for sales for the foreseeable future.