View from the Observation Deck

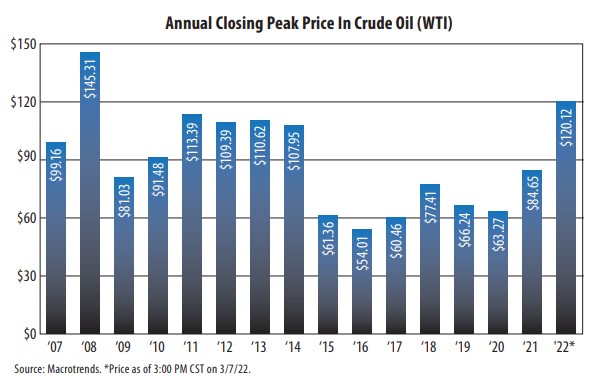

1. The price of West Texas Intermediate (WTI) crude oil stood at $120.12 per barrel at 3:00 PM CST on 3/7/22, up 81.75% from its closing price of $66.09 a year ago (3/5/21), according to Bloomberg.

2. For comparative purposes, the S&P 500 Energy Index posted a total return of 52.37% over that same period, according to Bloomberg. The top-performing energy subsector, of which there are five, was the S&P 500 Oil & Gas Exploration & Production Index, with a total return of 69.93%.

3. As indicated in the chart above, as elevated as the price of crude oil is it was considerably higher back in 2008, when it peaked at $145.31 per barrel.

4. While it is one thing for the price of a commodity, like crude oil, to spike from time to time, we have had instances where prices have remained at elevated levels for years. In other words, we have been here before and the high price of crude oil did not stymie the stock market.

5. From 2011-2014, the average price of WTI was $95.05 per barrel. Over the same period, the S&P 500 Index posted a cumulative total return of 78.28% (15.54% averaged annualized gain), compared to 26.35% (6.02% average annualized gain) for the S&P 500 Energy Index, according to Bloomberg.

6. Why is the $95 per barrel mark relevant today? The price range for WTI crude oil was $91.07 to $93.66 during the week leading up to Russia’s invasion of Ukraine on 2/24/22.

7. The recent gain in the relative value of the U.S. dollar (exchange rate) has not been a headwind for the price of crude oil. From 2/25/22 (date of invasion) through 3/7/22, the U.S. dollar rose by 2.76% against a basket of major foreign currencies, as measured by the U.S. Dollar Index (DXY), according to Bloomberg. The DXY stood at 99.29 on 3/7/22, well above its 30-year average of 91.34.

8. As of 3/7/22, Energy accounted for 4.15% of the S&P 500 Index, down from a 13.14% weighting at the end of 2008, according to Bespoke Investment Group and Bloomberg.

9. Investors funneled an estimated net $11.51 billion into Energy Equity mutual funds and exchange-traded funds (ETFs) in 2021, according to Morningstar.

10. The price of crude oil was steadily rising before Russia invaded Ukraine. While the market may have priced in the possibility of an invasion, the last $20-plus per barrel surge is essentially geopolitically-driven.