View from the Observation Deck

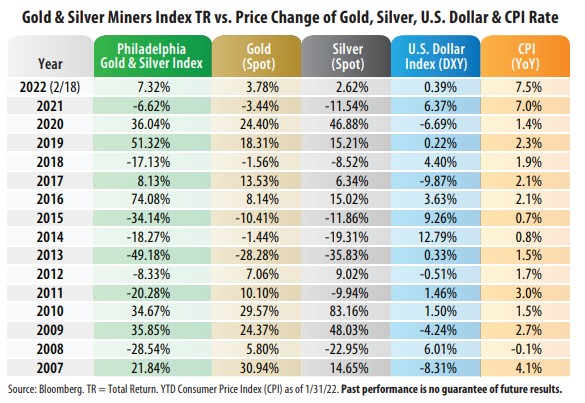

1. Today's blog post illustrates the wide disparities that often exist between the annual price performance of an ounce of gold bullion, silver and the equity returns posted by the mining companies.

2. Since precious metals tend to be priced in U.S. dollars, investors should also be aware of the relative strength of the U.S. dollar against other major global currencies, in our opinion.

3. Precious metals have historically been considered potential inflation hedges by investors, and it looks like it is working early on in 2022 (see table). From 1926- 2021, the CPI rate averaged 3.0%, according to data from the Bureau of Labor Statistics. It stood at 7.5% in January 2022.

4. Bank of America just reported that cryptocurrencies no longer resemble “digital gold” like they did at the start of the pandemic, according to Business Insider. Their correlation to gold is now close to zero.

5. As of 2/18/22, the price of gold closed trading at $1,898.60 per ounce, according to Bloomberg. The all-time closing high for the spot price is $2,060.59 per ounce, set on 8/6/20.

6. From 2007 through 2021, the Philadelphia Stock Exchange Gold & Silver Index only posted a positive total return in seven of the 15 calendar years, but four of them occurred from 2016 through 2020. It is positive YTD.

7. As of 2/22/22, Bloomberg's earnings per share figures (in dollars) for 2019, 2020 and 2021 (actual earnings) and consensus estimated earnings per share for 2022 and 2023 for the Philadelphia Stock Exchange Gold & Silver Index were as follows: $1.00 (2019); $4.62 (2020); $6.16 (2021); $7.43 (2022 Est.); and $7.76 (2023 Est.).

8. In addition to being considered as an inflation hedge, precious metals can also be a potential safe haven for investors during periods of elevated geopolitical risk, in our opinion. Keep an eye on the developments between Russia and Ukraine.