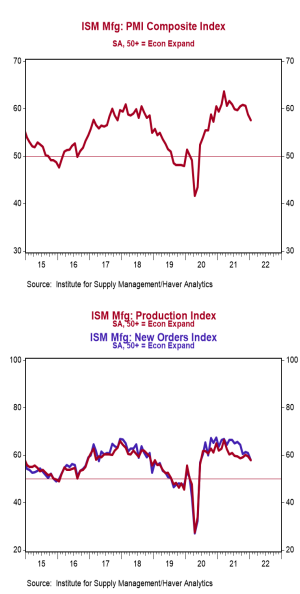

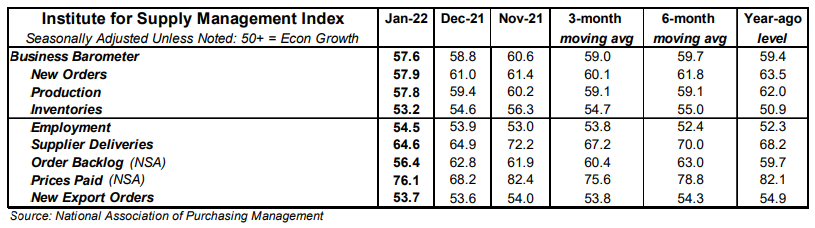

- The ISM Manufacturing Index declined to 57.6 in January, narrowly beating the consensus expected 57.5. (Levels higher than 50 signal expansion; levels below 50 signal contraction.)

- The major measures of activity were mixed in January, but all stand above 50, signaling growth. The production index fell to 57.8 from 59.4 in January, while the new orders index declined to 57.9 from 61.0. The employment index rose to 54.5 from 53.9, and the supplier deliveries index fell to 64.6 from 64.9 in January.

- The prices paid index rose to 76.1 in January from 68.2 in December.

Implications:

The manufacturing sector continued to expand in January, though at a slightly slower pace, with fourteen of eighteen industries reporting growth. While both the new orders and production indices remain in expansion territory, the rate of that expansion has been slowing consistently for roughly a year as a slew of unusual factors continue to interrupt supply chains. Respondent comments in January continued to be dominated by widespread worries about long lead times for inputs, labor shortages and retention, and transportation pressures. These issues have all come together to keep manufacturing activity from rising quickly enough to meet the explosion of demand as the US economy reopens. However, there has been recent progress on several fronts. For example, the supplier deliveries index looks to have peaked in May and fell for a third consecutive month in January, signaling that supply-chain issues are easing. That said, delays are far from over, with sixteen of eighteen industries reporting waiting longer for inputs. This, in turn, has resulted in long lead times for the clients of US factories, who continued to see their inventories shrink in January. The good news is that the rate at which those inventories are shrinking has begun to slow. There has also been recent progress on hiring, with the employment index rising for the fifth month in a row. However, staffing troubles remain a persistent issue when it comes to ramping up production. Manufacturing is one of the worst-hit sectors in the ongoing labor shortage, with job openings twice what they were pre-pandemic. Notably, the recent recovery in the employment index has coincided with the end of generous federal pandemic unemployment benefits which expired in September. With fewer disincentive effects in the labor market, we expect the shortage of workers to continue to abate in the coming months. Finally, the highest reading of any index in January continued to come from the prices index, which rose to 76.1 from 68.2 in December. While this is considerably slower than the peak reading of 92.1 in June, it still represents rapid increases in prices from a historical perspective. Our view continues to be that inflation remains a problem but won't be quite as rapid in 2022 as it was last year. In other news this morning, construction rose 0.2% in December (+0.9% including revisions to prior months), with large increases in homebuilding more than offsetting declines in manufacturing, transportation, and sewage and waste disposal projects.