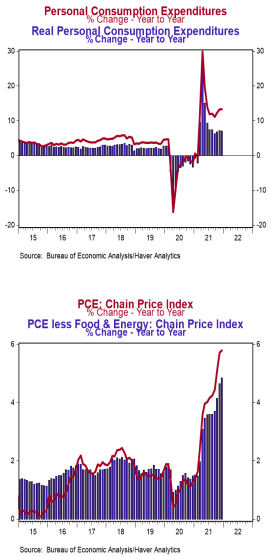

- Personal income rose 0.3% in December (+0.6% including revisions to prior months), coming in below the consensus expected +0.5%. Personal consumption declined 0.6% in December (-0.7% including prior months' revisions), matching consensus expectations. Personal income is up 7.3% in the past year, while spending has increased 13.3%.

- Disposable personal income (income after taxes) increased 0.2% in December and is up 5.6% from a year ago.

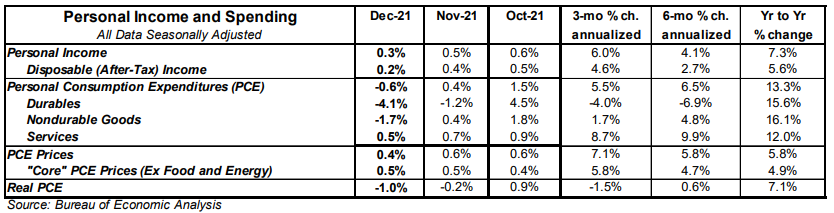

- The overall PCE deflator (consumer prices) rose 0.4% in December and is up 5.8% versus a year ago. The “core” PCE deflator, which excludes food and energy, rose 0.5% in December and is up 4.9% in the past year.

- After adjusting for inflation, “real” consumption declined 1.0% in December, but is up 7.1% from a year ago.

Implications:

Incomes rose while spending moderated in December, as an early start to holiday purchases meant less demand for last-minute purchases. While the 0.3% rise in personal income for December was short of consensus expectations, there were two notable positives on the income front: 1) upward revisions to prior months’ data mean that income in December rose 0.6% from the originally reported November number, and 2) the rise in income came almost entirely from private-sector wages and salaries, which is a far more important (and sustainable) source of income than the government transfer payments, which were a major driver of income growth throughout much of 2020 and 2021. With the December gain of 0.8%, private sector wages and salaries are now up a whopping 10.0% in the past year. Despite the extra funds to spend during the holiday season, it looks like many people got their shopping done early this year (note the 1.5% jump in spending in October and 0.4% rise in November). We expect a rebound back to spending growth in the months ahead. Job growth continues, wages are going up quickly, and some people saved transfer payments they received during COVID, giving them more (temporary) spending power. On the inflation front, PCE prices grew 0.4% in December, and are up 5.8% from a year ago. Core prices, which exclude food and energy, rose 0.5% in December and are up 4.9% from a year ago, supporting the Federal Reserve’s guidance to finish tapering and begin lifting rates at the next meeting in March. In other recent news, the Kansas City Fed Index, a measure of factory sentiment in that region, rose to 24 in January from 22 in December. On the housing front, pending home sales, which are contracts on existing homes, declined 3.8% in December following a 2.3% drop in November. These figures suggest downward pressure on January existing-home sales, which are counted at closing.