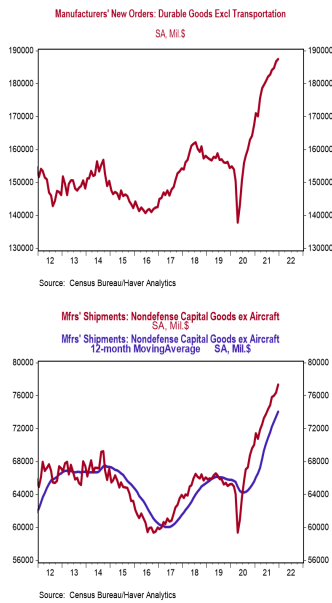

- New orders for durable goods declined 0.9% in December (+0.3% including revisions to prior months), versus a consensus expected decline of 0.6%. Orders excluding transportation rose 0.4% in December (+0.6% including revisions), versus a consensus expected gain of 0.3%. Orders are up 12.7% from a year ago, while orders excluding transportation are up 11.9%.

- The decline in orders in December was led by aircraft and computers & electronic products.

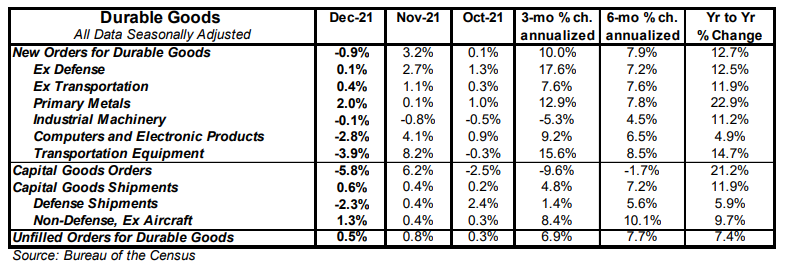

- The government calculates business investment for GDP purposes by using shipments of non-defense capital goods excluding aircraft. That measure increased 1.3% in December and was up at an 8.6% annualized rate in Q4 versus the Q3 average.

- Unfilled orders rose 0.5% in December and are up 7.4% in the past year.

Implications:

New orders for durable goods fell slightly short of consensus expectations in December, but the decline was heavily concentrated in the notoriously volatile transportation category. Strip out transportation, and the headline decline of 0.9% in December turns into a 0.4% rise, while upward revisions to prior months show “core” activity in December was up 0.6% from the originally reported pace of orders in November. In 2021, durable goods orders rose an impressive 12.7%, representing the largest full-year increase since 2011. And with a combined 65.4% increase since the April 2020 bottom, new orders now sit 15.9% above the pre-pandemic high in February 2020, signaling a sharp (and more checkmark than V-shaped) recovery in durable goods. Looking at the details of today’s report, the volatile transportation sector once again lived up to its name, with sizeable declines in orders for both commercial and defense aircraft partially offset by a rise in orders for autos. Beyond transportation, orders were mixed in December, with primary metals (+2.0%) and fabricated metal products (+1.5%) rising, while orders for computers & electronic products (-2.8%), and machinery (-0.1%) declined. One of the most important pieces of today’s report, shipments of “core” non-defense capital goods ex-aircraft (a key input for business investment in the calculation of GDP), rose 1.3% in December. In the fourth quarter, these shipments rose at an 8.6% annualized rate versus the Q3 average. For a deeper dive on how the U.S. economy performed in Q4, click here to read our analysis of the fourth quarter GDP report released this morning. In other news, initial jobless claims fell 30,000 last week to 260,000. Meanwhile, continuing claims for regular benefits rose 51,000 to 1.675 million. Plugging these figures into our models suggests continued job growth in January. Given the heightened attention on the Federal Reserve as it plans rate lift-off at the next meeting in March, every report on employment or inflation will get elevated scrutiny as market participants try to gauge how it will impact the pace (and magnitude) of Fed moves in the year ahead.