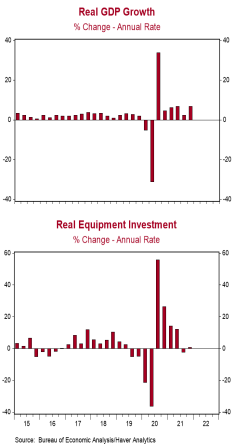

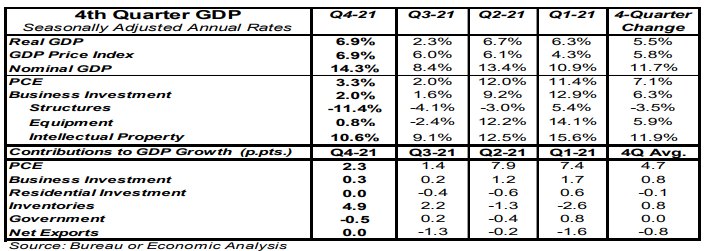

- Real GDP grew at a 6.9% annual rate in Q4, beating the consensus expected 5.5%.

- The largest positive contributions to the real GDP growth rate in Q4 were inventories and personal consumption. The largest drags on growth were government purchases and commercial construction.

- Personal consumption, business investment, and home building, combined, grew at a 2.8% annual rate in Q4.

- The GDP price index increased at a 6.9% annual rate in Q4 and is up 5.8% from a year ago. Nominal GDP (real GDP plus inflation) rose at a 14.3% annual rate in Q4 and is up 11.7% from a year ago.

Implications:

Real GDP grew at a 6.9% annual rate in the fourth quarter, easily beating the consensus expected 5.5%. As a result, real GDP was up 5.5% in 2021 (Q4/Q4), the fastest growth for any calendar year since the Reagan Boom in 1984. However, today’s data were not all unicorns and rainbows. Most of the growth in Q4 itself was due to a much faster pace of inventory accumulation, which will not be repeated in 2022. And in spite of rapid growth in 2021, real GDP finished the year only up at a 1.6% annual rate since the end of 2019, which is slower than the pre-COVID trend. In other words, the US economy is still smaller than it would have been if COVID and the related lockdowns had never happened. Unlike the Reagan Boom or other periods of robust economic growth, the growth in 2021 was artificially boosted by massive government spending and a recovery from the most draconian period of COVID restrictions in 2020. But do you know what’s clearly higher than the pre-COVID trend? Inflation. GDP prices rose at a 6.9% annual rate in Q4 and prices rose 5.8% in 2021 (Q4/Q4), the largest gain for any calendar year since 1981. GDP prices are up 3.6% annualized since right before COVID hit, which, unlike real GDP, is clearly above trend. Combining real GDP growth and inflation gives us nominal GDP, which is up at a 5.2% annual rate since right before COVID, very close to the pre-COVID trend. This year will be marked by transitions for the US economy, including slower economic growth, slower (but stubbornly high) inflation, and a liftoff for short-term interest rates. Look for real GDP growth of around 2.5% in 2022 while GDP prices rise around 4.0%. Why slower economic growth? Because massive government spending in 2020-21 artificially covered up economic pain like an opioid given to a crash victim. But more doses of opioids are becoming less likely, meaning growth is heading back toward a more normal level. In terms of the details of today’s report, consumer spending was bolstered by growth in spending on services, while government purchases and commercial construction both contracted for the quarter. The big issue for the next few years is whether the government will get enough out of the way so entrepreneurs and businesses can maintain solid growth to compensate for the economic headwinds the government has created.

1 thought on “GDP Q4 2021”