View from the Observation Deck

1. Equities appear to be on the cusp of delivering the market correction, as measured by the S&P 500 Index, that many pundits have been forecasting.

2. A correction is usually defined as a 10.00% to 19.99% decline in the price of a security or index from its most recent peak. A bear market is defined as a 20.00% or greater decline in the price of a security or index.

3. As of the close on 1/25/22, the S&P 500 Index stood 9.18% below its all-time closing high of 4,796.56 (1/3/22), just shy of correction territory, according to Bloomberg.

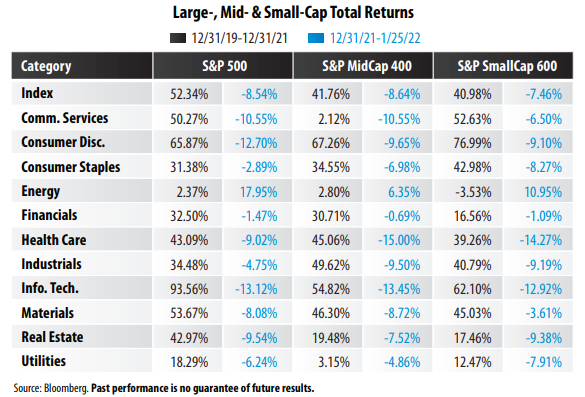

4. The three major indices featured in the table comprise the S&P Composite 1500 Index, which represents approximately 90% of total U.S. equity market capitalization (cap), according to S&P Dow Jones Indices.

5. For comparative purposes, at the close of 1/25/22, the S&P MidCap 400 and S&P SmallCap 600 Indices stood 10.84% and 11.55% below their respective all-time highs. Both are already in correction territory.

6. Large-cap stocks performed significantly better than their mid- and small-cap counterparts from 2020-2021 (black columns). YTD through 1/25/22, large-caps were in line with the performance of mid-caps, but were down a bit more than small-caps for the period (see table above). From 12/31/19 through 1/25/22 (period covered in the table that captures the COVID-19 pandemic), the S&P 500, S&P MidCap 400 and S&P SmallCap 600 Indices posted cumulative total returns of 39.38%, 29.55% and 30.61%, respectively, according to Bloomberg.

7. Sector performance can vary widely by market cap (see table). A couple of the more extreme cases (2020-2021) include Information Technology, Real Estate and Utilities.

8. As of the close on 1/26/22, the percentage of stocks in the S&P 500, S&P MidCap 400 and S&P SmallCap 600 Indices trading above their 50-day moving averages were 30%, 18% and 21%, respectively.

9. The percentage of stocks in the S&P 500, S&P MidCap 400 and S&P SmallCap 600 Indices trading above their 200-day moving averages were 42%, 29% and 32%, respectively.

10. Moving averages tend to smooth out day-to-day price fluctuations and can be a useful tool for traders and investors to identify both positive trends and reversals, in our opinion.