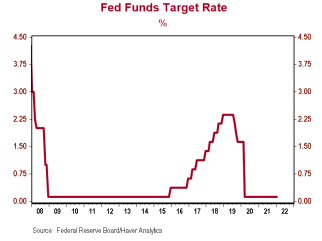

The Fed stayed the course today, with no change in the Fed Funds rate, no adjustment to the pace of tapering, no shift in the timeline for raising rates, and no indication that they intend to lift rates in larger steps.

Barring a sharp change in the economic outlook, the Fed looks virtually certain to raise the Fed Funds rate by 25 basis points at the March meeting. When pushed during the press conference, Chair Powell was very intentional not to commit to a pace of hikes as the year progresses. We could see hikes at every meeting or every other meeting, only time (and the data) will tell.

One area where we did get some clarification from the Fed came with regards to the balance sheet. In addition to confirming that tapering will conclude in early March, the Fed published guidance on the path towards reducing the size of the balance sheet. Some have questioned if the normalization process would start in March along with rate hikes, but today’s announcement shows the Committee expects to wait until after rate hikes are under way. It was also notable that there was no indication that the Fed is considering the outright sale of assets. Instead, guidance mimicked reductions coming through the management of monthly reinvestments as occurred back in 2017. The Fed is behind the curve on fighting inflation, tapering should already be over, and rate hikes should already have begun. The risk today is that the Fed moves too slowly, not too quickly. Inflation is likely to remain stubbornly high throughout 2022 and beyond, and the biggest question today is how long it takes for the Fed to step up to the challenge.

Text of the Federal Reserve's Statement:

Indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in COVID-19 cases. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses. The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus. The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month. The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Brian S. Wesbury, Chief Economist

Robert Stein, Deputy Chief Economist

Voting for the monetary policy action were Jerome H.

Powell, Chair; John C. Williams, Vice Chair; Michelle W.

Bowman; Lael Brainard; James Bullard; Esther L. George;

Patrick Harker; Loretta J. Mester; and Christopher J.

Waller. Patrick Harker voted as an alternate member at this

meeting.