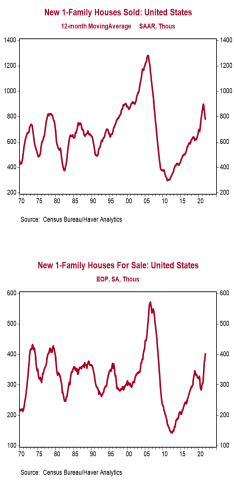

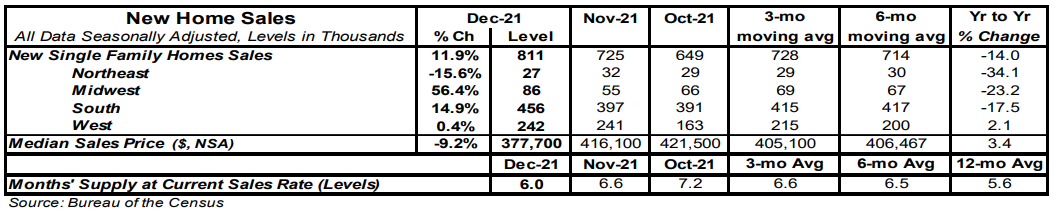

- New single-family home sales increased 11.9% in December to a 0.811 million

annual rate, easily beating the consensus expected 0.760 million. Sales are down

14.0% from a year ago. - Sales in December rose in the Midwest, South, and West, but fell in the Northeast.

- The months’ supply of new homes (how long it would take to sell all the homes in

inventory) fell to 6.0 in December from 6.6 in November. The drop was entirely

due to a faster pace of sales which more than offset a 6,000 unit increase in

inventories. - The median price of new homes sold was $377,700 in December, up 3.4% from a

year ago. The average price of new homes sold was $457,300, up 13.8% versus last year.

Implications:

New home sales surprised to the upside in December, posting a second consecutive double-digit percentage gain to finish 2021 on a strong note. That said, looking at the year as a whole shows 765,000 new homes were sold which is down 7.5% from 2020’s breakneck pace. So, why the slowdown? We think for two main intertwined reasons: a lack of supply of completed homes plus rapid price appreciation versus pre-COVID levels. The good news is that builders have been ramping up activity, with the total number of singlefamily homes under construction currently at the highest levels since 2007. Ultimately, that added supply will facilitate more sales while slowing the pace of new home price appreciation. In the meantime, buyers are still stuck dealing with very few options when it comes to completed homes. It's true that overall inventories have been rising recently and now sit at the highest level since 2008. This has pushed up the months’ supply (how long it would take to sell the current inventory at today’s sales pace) to 6.0 from a record low reading of 3.5 in late 2020. However, almost all of this inventory gain is from homes where construction has either not yet started or is still underway. Doing a similar calculation with only completed homes on the market shows a months’ supply of a meager 0.6, near the lowest level on record back to 1999. The good news is that the inventory of completed homes has been rising consistently since July, signaling a return to an upward trend after nearly a year straight of declines. It also looks like more affordable options are becoming available on the market as well, with sales of properties worth $200-399k surging from 41% of total sales to 53% in the past two months. This shift in the mix of homes sold has helped put the brakes on median sales prices, which are now up only 3.4% in the past year, a big deceleration from October’s reading of 21.5%. Given that builders have plenty of projects in the pipeline to meet demand, it looks likely that they will keep construction activity running on all cylinders for the foreseeable future. As more homes become available, we expect demand will remain strong and help boost sales in 2022. In other recent housing news, the national Case-Shiller index rose 1.1% in November, a large gain by normal standards, but a slowdown from earlier in 2021. Still, the index is up 18.8% from a year ago, led by price gains in Phoenix and Tampa, with the slowest gains in Chicago, Minneapolis, and Washington, DC. The FHFA index, which measures prices for homes financed by conforming mortgages, increased 1.1% in November as well and is up 17.6% from a year ago. Finally, the Richmond Fed Manufacturing Index, which measures mid-Atlantic manufacturing sentiment, fell to a still robust +8 in January from +16 in December.