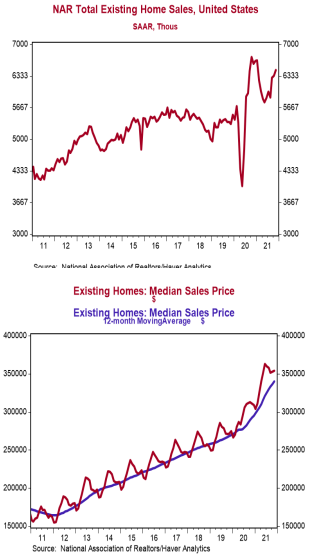

- Existing home sales declined 4.6% in December to a 6.180 million annual rate, lagging the consensus expected 6.420 million. Sales are down 7.1% versus a year ago.

- Sales in December fell in all major regions. The decline was due to both single-family homes and condos/co-ops.

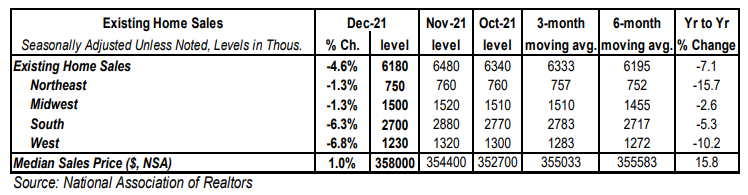

- The median price of an existing home rose to $358,000 in December (not seasonally adjusted) and is up 15.8% versus a year ago. Average prices are up 9.6% versus last year.

Implications:

After posting three consecutive gains, existing home sales took a breather in December. However, even though sales ended the year on a weak note, looking at all of 2021 shows a healthy picture. Overall, 6.12 million existing homes were sold during the year, the highest calendar-year level since 2006 and an 8.5% gain over 2020. This is doubly impressive given the current lack of supply in the market. The number of listed, but unsold, existing homes was 910,000 in December, an all-time low going back to 1999. Our expectation is that listings will move upward in 2022, at least on a seasonally adjusted basis, as virus fears fade in the Spring and sellers feel more comfortable showing their homes. Meanwhile, the months’ supply of existing homes for sale (how long it would take to sell today’s inventory at the current sales pace) fell to 1.8 months in December, also a record low back to 1999. Despite the ongoing shortage of listings, there is still significant pent-up demand from the pandemic, with buyer urgency so strong in December that 79% of existing homes sold were on the market for less than a month. The combination of strong demand and sparse supply has pushed median prices up 15.8% in the past year, but the good news is that price gains have decelerated since hitting a year-to-year gain of 23.6% in May. Looking forward to 2022, we expect another solid year as more inventory becomes available and price gains moderate. Millennials are now the largest living generation in the US and have begun to enter the housing market in force, making up over 50% of new mortgage issuance for the first time in 2019. This represents a demographic tailwind for sales for the foreseeable future. In other news this morning, initial unemployment claims rose 55,000 last week to 286,000. Meanwhile, continuing claims increased 84,000 to 1.635 million. Finally, on the manufacturing front, the Philadelphia Fed Index, a measure of factory sentiment in that region, rose to +23.2 in January from +15.4 in December.