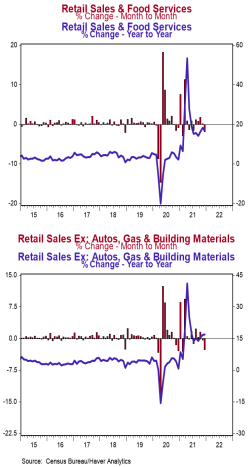

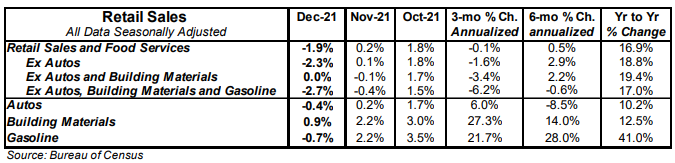

- Retail sales declined 1.9% in December, falling well short of the consensus expected decline of 0.1%. Retail sales are up 16.9% versus a year ago.

- Sales excluding autos declined 2.3% in December, far below the consensus expected gain of 0.1%. These sales are up 18.8% in the past year. Excluding gas, sales fell 2.0% in December, but are up 15.1% from a year ago.

- The decline in sales in December was led by online retailers, department stores, and clothing.

- Sales excluding autos, building materials, and gas fell 2.7% in December, but were up at a 5.3% annual rate in Q4 versus the Q3 average.

Implications:

Retail sales missed the mark by a wide margin in December, falling 1.9% as most major categories declined. A number of factors contributed to the drop in sales in December. First, consumers pulled forward some of their Christmas shopping into October (when sales rose a whopping 1.8% for the month) as fears of shortages were on everyone’s mind. Retail sales in the fourth quarter as a whole were up 2.1% versus the third quarter and up 17.1% versus a year ago. Second, rising Omicron cases across the country (temporarily) affected both consumers’ ability to go out, and companies’ abilities to staff stores. And third, retail sales were pushed up massively during the government spending and moneyprinting bonanza of 2020 and early 2021, while at the same time consumers couldn’t engage portions of the service sector, pushing even more activity towards buying goods. That means it was always going to be difficult for sales to continue to rise near the same pace once checks stopped flowing. This will be important to remember across 2022; a flat to downward trend in retail sales is simply activity coming back down toward normal. All that said, overall sales are still up a robust 16.9% in December compared to a year ago and have risen 19.2% since February of 2020. Looking at the details of today’s report show activity slowed virtually across the board, with outsized declines among non-store retailers (think online shopping). Gas station sales declined, which was to be expected given the drop in national gas prices in December. “Core” sales, which exclude the most volatile categories of autos, building materials, and gas, fell 2.7% in December, but remain up 17.0% from a year ago. In other words, even with a weak December report, retail sales are running much hotter than they would have had COVID never happened, even as the level of output (real GDP) is still running lower than it would have been in the absence of COVID. While areas like online shopping, sporting goods stores, and gas stations have had above-trend growth since COVID began, areas like restaurants & bars weren’t back to pre-COVID levels until April of 2021, and the winter rise in COVID cases is bringing volatility to their sales once again. In the months ahead, the path of retail sales will be a battle between a number of opposing factors. Rising wages, jobs, and inflation will all be tailwinds for retail sales, while the waning of the temporary and artificial boost from “stimulus” checks and other government benefits will be headwinds. In other news this morning, import prices fell 0.2% in December while export prices declined 1.8%. However, in the past year, import prices are up 10.4%, while export prices are up 14.7%. Expect prices to move higher in the months ahead as Omicron wanes and monetary policy – both here and abroad – remain overly loose.

This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward looking statements expressed are

subject to change without notice. This information does not constitute a solicitation or an offer to buy or sell any security